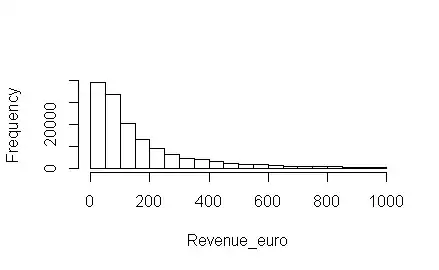

I have been meaning to fit an exponential smoothing model to a monthly series that looks like the one below:

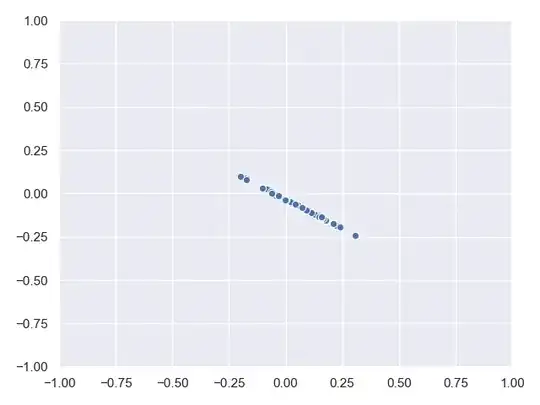

When I decompose the series it is almost evident that we have seasonality and also there seems to be an exponential trend in the series. Here is the result:

I first used ets function to apply it on my training set and the diagnostic was an ETS model with additive error, but neither seasonality nor trend:

fit2 <- ets(training)

fit2

ETS(A,N,N)

Call:

ets(y = training)

Smoothing parameters:

alpha = 0.4596

Initial states:

l = 354.3194

sigma: 155.3593

AIC AICc BIC

365.3796 366.4231 369.2672

And the Ljung-Box test also looks fine:

fit2 %>% checkresiduals()

Ljung-Box test

data: Residuals from ETS(A,N,N)

Q* = 2.235, df = 3, p-value = 0.5251

Model df: 2. Total lags used: 5

When I plot the forecasts for 4 months ahead, it seems to be a straight line, as the model doesn't capture the dynamics of the series:

Now I have 2 questions:

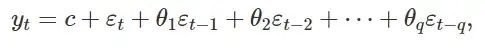

- Do I need to detrend & deseaonalize the times series with lag 1 and lag 12 differencing before applying an

etsmodel on it. Because I heard from Mr. Hyndman on a datacamp tutorial that we just have to plug in the series intoetsso, I am a bit confused here. If I useHoltWinterfunction I will get a different result, but I don't know the difference between these two. - Do this model seems legitimate and correct? I am not sure why it could not capture the dynamics here but since there is a seamingly polynomial trend here I thought that might lead to

etsdiagnose the trend toN, but what about seasonality? why it cannot be catpured?

Thank you very much for your advice in advance I really appreciate it.