I have a problem with a dataset where I do not exactly know how to work with.

Here it is:

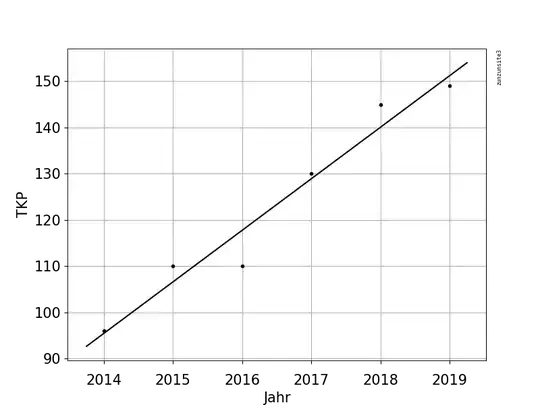

Jahr GRP TKP COST

1 2012 100 100 100

2 2013 92 95 88

3 2014 88 96 85

4 2015 78 110 87

5 2016 84 110 94

6 2017 76 130 100

7 2018 65 145 97

8 2019 63 149 96

My company wants to predict the values for "TKP" for the upcoming year 2020. The covariates for the model are "GRP" and "COST". I don´t have the values for my covariates too, so actually my prediction is just based on data from the past.

I can not just run a regression or something like this, because I would need to covariates for 2020 to do this, right? Do I have to predict TKP and COST first with something like ARIMA and then predict the GRP with a regression model? Is my dataset large enough to predict anything? Our predictions will be measured against the predictions of the system, which should just the average change of the last years, nothing special.

Can you help me how to work with on this problem?