This question has been asked before with very good (but incomplete) answers. This and this are the two best answers that I found. But following is my doubt:

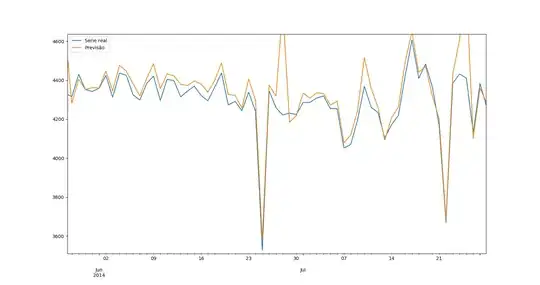

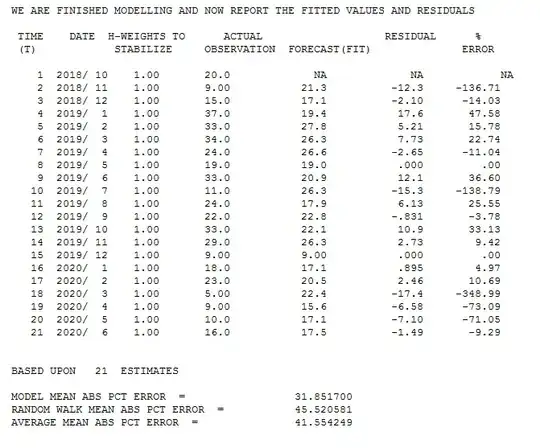

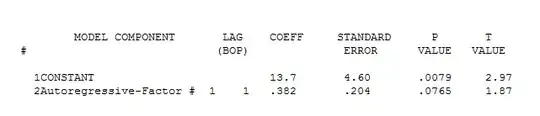

Top answers from both (by IrishStat) the links suggest to fit a common model to both the time series and then globally. I understand that if the same series was split in two parts, chow test can be used comparing the estimated models of the two splits with the estimated global model.

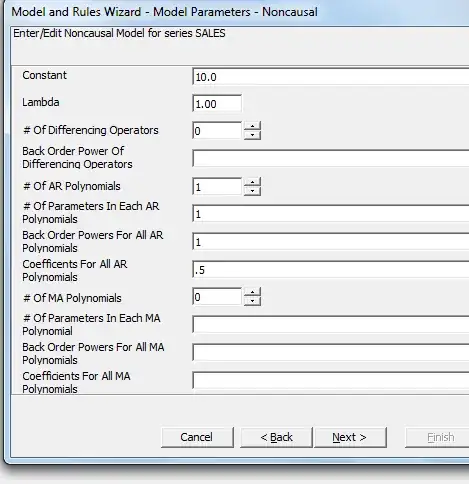

However, if the two time series are different (say urban and rural inflation), and the comparison is to be done for the same time window, IrishStat suggests "..( putting the second series behind the first ) . Make sure that your software recognizes the beginning of the scond series.."

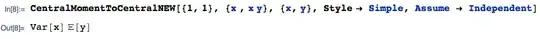

Question: how to do this? Do we need to add a dummy (LS outlier type?). If so, would it not disturb the estimate of the global model. In fact there should be no global model in the strict sense. Joining two time series assumes a dependence structure between last point of first series and first point of second series, where there may not be any.