How to statistically compare two time series?

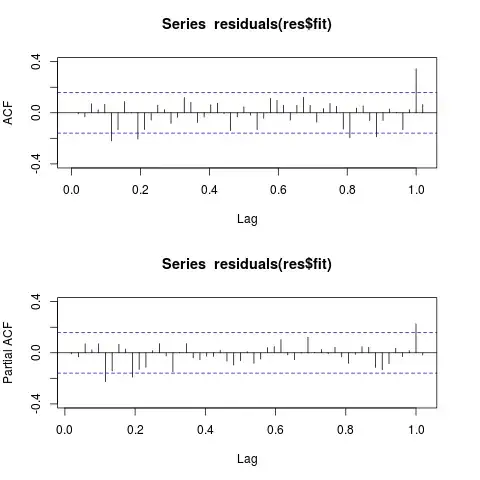

After reading the above responses, I realized that what I should be doing for my data is exactly what https://stats.stackexchange.com/users/3382/irishstat recommended. However, I am having trouble determining the correct parameters for the arima(p,d,q) function in r. Could someone provide a detailed tutorial for how to correctly choose these values? I know that the time series need to be stationary, which is simple enough to test. I also know the acf/pacf graphs are used for this, but it's still a bit foggy and I want my statistics to be sound. I have been unable to find a successful guide- most of the walkthroughs I have seen skim over the part of choosing the p,d,q values.

EDIT: I've added the 2 time series that I have been working on. The data is sampled bi-monthly for 9 months (excepting Dec, Jan, and Feb). alpha, in this case, is the TN data aggregated by month and year, which allowed me to coerce it to a time series. For our purposes, monthly averages are good enough to display what we are trying to look at. Another important note, these 2 time series have the proper time window, etc., but they are merely examples. They are not the final time series that I will use in the analysis. Final note, the NAs in the first time series caused gaps in the plots, but it is not difficult to apply a gap-filling function, which would generate a plot much like the second.

These time series are clearly not models, but simply points stored in the time series format. I believe that using a model is the best way to compare them, but I am not sure. I was also able to decompose the model to remove the seasonal data, and I was curious if it would be better to compare the series with the seasonal component removed.

alpha <- with(alpha,

aggregate(TN~Month+Year, FUN = mean, na.rm=T)

)

> alpha

Month Year TN

1 3 2011 2.550675

2 4 2011 2.166793

3 5 2011 1.666279

4 6 2011 1.235067

5 7 2011 1.306130

6 8 2011 1.380530

7 9 2011 1.434623

8 10 2011 1.599755

9 11 2011 2.261617

10 3 2012 2.529887

11 4 2012 1.938779

12 5 2012 1.700785

13 6 2012 1.160013

14 7 2012 1.099877

15 8 2012 1.244322

16 9 2012 1.471384

17 10 2012 1.695036

18 11 2012 1.959646

19 3 2013 2.808547

20 4 2013 2.546227

21 5 2013 2.112756

22 6 2013 1.875753

23 7 2013 1.882885

24 8 2013 2.010292

25 9 2013 1.771419

26 10 2013 1.820127

27 11 2013 2.351775

28 3 2014 3.002976

29 4 2014 2.286398

30 5 2014 2.177926

31 6 2014 1.772718

32 7 2014 1.245376

33 8 2014 1.274671

34 9 2014 1.378657

35 10 2014 1.554602

36 11 2014 1.702360

37 3 2015 2.771875

38 4 2015 2.373219

39 5 2015 2.025162

40 6 2015 1.607793

41 7 2015 1.656044

42 8 2015 1.525059

43 9 2015 1.494547

44 10 2015 1.746673

45 11 2015 1.942351

V1 <- as.numeric(rep(c(12,1,2),4))

V2 <- as.numeric(c(2011, rep(2012,3), rep(2013,3), rep(2014,3),rep(2015,2)))

V3 <- rep(NA, 12)

df1 <- data.frame(V1,V2,V3)

names(df1) <- c('Month', 'Year', 'TN')

TNMonthsFilled <- rbind(alpha, df1) #adds in dates for Dec-Feb as NAs

TNMonthsFilled$Date <- as.Date(with(TNMonthsFilled, paste(Year, as.numeric(Month), as.numeric(15),sep="-")), "%Y-%m-%d") #converts values back to dates

TNOrdered <- TNMonthsFilled[order(TNMonthsFilled$Date),] #orders dates for coercion to ts

TNts <- with(TNOrdered, ts(TN, start = c(2011,3), end = c(2015,11), frequency = 12)) #TS with NAs

plot(TNts)

Nan_Up_Ag <- with(Nan_Up,

aggregate(TN~Date, FUN = mean, na.rm=T)

)

> Nan_Up_Ag

Date TN

1 2011-04-15 3.3625000

2 2011-05-15 2.8972222

3 2011-06-15 3.6680000

4 2011-07-15 1.8125000

5 2011-08-15 1.5816667

6 2011-09-15 2.5475000

7 2011-10-15 3.4550000

8 2011-11-15 3.9600000

9 2012-04-15 3.5683333

10 2012-05-15 2.6991667

11 2012-06-15 2.0630000

12 2012-07-15 1.6233333

13 2012-08-15 1.4250000

14 2012-09-15 2.3961111

15 2012-10-15 2.9616667

16 2012-11-15 3.8216667

17 2013-03-15 4.6820000

18 2013-04-15 5.6225000

19 2013-05-15 3.5658333

20 2013-06-15 0.4916667

21 2013-07-15 2.8266667

22 2013-08-15 2.9216667

23 2013-09-15 2.7991667

24 2013-10-15 2.5875000

25 2013-11-15 3.4583333

26 2014-03-15 4.6200000

27 2014-04-15 3.9941667

28 2014-05-15 3.4116667

29 2014-06-15 2.8661111

30 2014-07-15 2.2483333

31 2014-08-15 2.0416667

32 2014-09-15 2.1316667

33 2014-10-15 2.6465000

34 2014-11-15 3.2133333

35 2015-03-15 4.1460000

36 2015-04-15 4.1650000

37 2015-05-15 3.6616667

38 2015-06-15 3.0483333

39 2015-07-15 2.8133333

40 2015-08-15 2.4466667

41 2015-09-15 2.1983333

42 2015-10-15 3.0233333

43 2015-11-15 3.3060000

Nan_Up_ts <- with(Nan_Up_Ag, ts(TN, start = c(2011,3), end = c(2015,11), frequency = 12))

plot.ts(Nan_Up_ts)