I am trying to test for cointegration between two series that based on qualitative reasoning, should be cointegrated. They are the prices of XLE ETF (XLE US equity) and 1st futures of Brent (CO1 Comdty). However, the results that I arrive at using two different methods both show that there exists no cointegration between the two series - not sure if my execution or the interpretation of the data is wrong?

(Both XLE and Brent 1st Futures have been tested for non-stationarity using ADF test from "urca" package)

1st test - Engle Granger 2-step test:

In doing this, I referenced Using R to Test Pairs of Securities for Cointegration by Paul Teetor

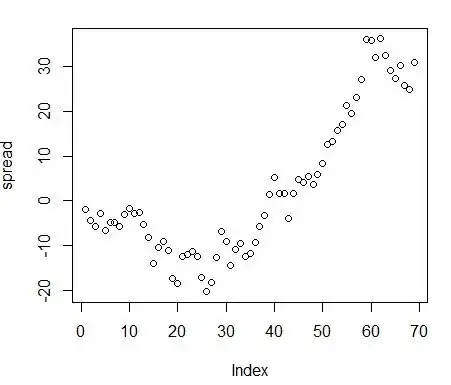

(1) Conducting Spread

> M<-lm(XLE~Brent+0,data=XLE.Brent)

> beta<-coef(M)[1]

> spread<-XLE.Brent$XLE-beta*XLE.Brent$Brent

>

> summary(M)

Call:

lm(formula = XLE ~ Brent + 0, data = XLE.Brent)

Residuals:

Min 1Q Median 3Q Max

-20.363 -9.543 -2.909 13.294 36.269

Coefficients:

Estimate Std. Error t value Pr(>|t|)

>Brent 0.74962 0.02004 37.4 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 16.37 on 68 degrees of freedom

Multiple R-squared: 0.9536, Adjusted R-squared: 0.953

F-statistic: 1399 on 1 and 68 DF, p-value: < 2.2e-16

(2) Testing the stationarity of the spread using ADF test (from package "urca"):

> spread.ADF<-ur.df(spread,type="none",selectlags="AIC")

> summary(spread.ADF)

###############################################

# Augmented Dickey-Fuller Test Unit Root Test #

Test regression none

Call:

lm(formula = z.diff ~ z.lag.1 - 1 + z.diff.lag)

Residuals:

Min 1Q Median 3Q Max

-6.1449 -2.2523 0.5559 2.9194 8.4567

Coefficients:

Estimate Std. Error t value Pr(>|t|)

z.lag.1 -0.0003928 0.0266919 -0.015 0.988

z.diff.lag 0.1207084 0.1278700 0.944 0.349

Residual standard error: 3.443 on 65 degrees of freedom

Multiple R-squared: 0.01395, Adjusted R-squared: -0.01639

F-statistic: 0.4596 on 2 and 65 DF, p-value: 0.6335

Value of test-statistic is: -0.0147

Critical values for test statistics:

1pct 5pct 10pct

tau1 -2.6 -1.95 -1.61

My interpretation: since $t$-value = -0.0147 is bigger than -1.61, do not reject null. Spread is not stationary. Hence no cointegration between XLE and Brent.

Second Test: Johansen Test

> XLE.brent.coint<-ca.jo(data.frame(XLE,Brent),type="trace",ecdet="trend",K=2,spec="longrun")

> summary(XLE.brent.coint)

>

>######################

># Johansen-Procedure #

>######################

>

>Test type: trace statistic , with linear trend in cointegration

>

>Eigenvalues (lambda):

>[1] 8.179514e-02 6.025284e-02 2.775558e-17

>

>Values of teststatistic and critical values of test:

>

> test 10pct 5pct 1pct

>r <= 1 | 4.16 10.49 12.25 16.26

>r = 0 | 9.88 22.76 25.32 30.45

>

>Eigenvectors, normalised to first column:

>(These are the cointegration relations)

>

> XLE.l2 Brent.l2 trend.l2

>XLE.l2 1.000000 1.0000000 1.0000000

>Brent.l2 1.467806 -0.4346323 0.1610563

>trend.l2 1.896366 -0.4903454 -0.8891875

>

>Weights W:

>(This is the loading matrix)

>

> XLE.l2 Brent.l2 trend.l2

>XLE.d -0.01629102 -0.13534537 -4.695795e-17

>Brent.d -0.03819241 -0.03886418 5.127543e-17

My interpretation: Since $t$-value for r=0: 9.88<22.76, do not reject null. Hence r=0, there exists no cointegration between XLE and Brent.

Additionally, I have carried out cointegration tests (both methods) on US 10 year and 2 year yields, and the results on both tell me that the series are not co-integrated, which does not make sense intuitively. Something must be wrong with the way I'm doing the tests!