In general, dig into an advanced time series analysis textbook (introductory books will usually direct you to just trust your software), like Time Series Analysis by Box, Jenkins & Reinsel. You may also find details on the Box-Jenkins procedure by googling. Note that there are other approaches than Box-Jenkins, e.g., AIC-based ones.

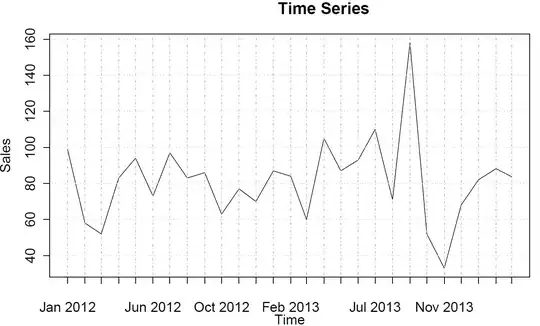

In R, you first convert your data into a ts (time series) object and tell R that the frequency is 12 (monthly data):

require(forecast)

sales <- ts(c(99, 58, 52, 83, 94, 73, 97, 83, 86, 63, 77, 70, 87, 84, 60, 105, 87, 93, 110, 71, 158, 52, 33, 68, 82, 88, 84),frequency=12)

You can plot the (partial) autocorrelation functions:

acf(sales)

pacf(sales)

These don't suggest any AR or MA behavior.

Then you fit a model and inspect it:

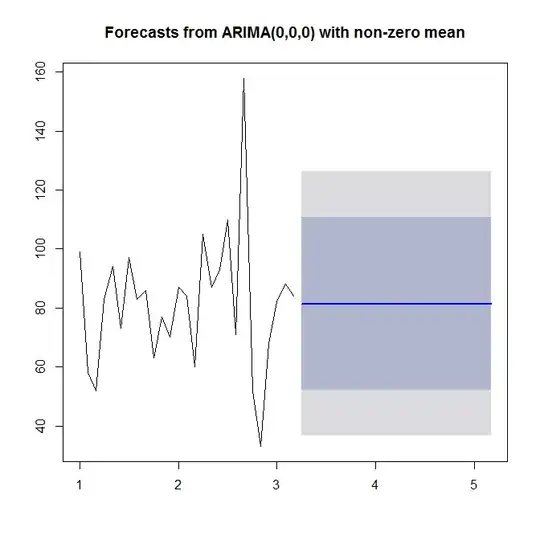

model <- auto.arima(sales)

model

See ?auto.arima for help. As we see, auto.arima chooses a simple (0,0,0) model, since it sees neither trend nor seasonality nor AR or MA in your data. Finally, you can forecast and plot the time series and forecast:

plot(forecast(model))

Look at ?forecast.Arima (note the capital A!).

This free online textbook is a great introduction to time series analysis and forecasting using R. Very much recommended.