I'm reading a paper that does not report the coefficients from two OLS regressions. In both cases there is 1 response variable and 1 predictor variable. The predictor variable is the same in both cases. I know the subject matter of the paper well, which leads me to believe that the means of the slopes are almost certainly between 0 and 1. Although the slopes for these two regressions are not reported, the author does report that neither slope is significantly different from 0 (p ≥ 0.05).

If neither slope is different from 0, but both slopes are between 0 and 1, could the slopes be different from each other?

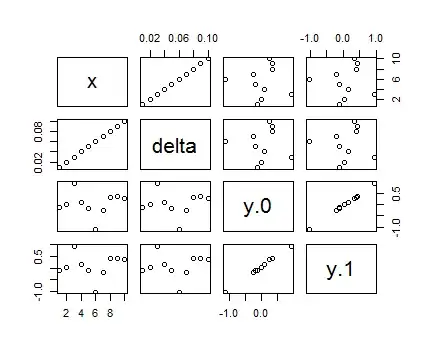

To try to figure this out, I did a quick test in R. I used two slopes that were very different (0.99 and 0.01), but chose s.e.'s for each that would make them barely "insignificant". To compare the slopes, I used the formula from the answer to THIS question.

pnorm(

(0.99 - 0.01)/ #difference between means

sqrt(0.61^2 + 0.0062^2), #sqrt of sum squares of s.e.'s

lower.tail=FALSE

)

OK, so this quick-and-dirty test suggests that the two slopes in the author's analysis can't be different.

Is it necessarily true that if two slopes are between 0 and 1, and neither different from 0, that they cannot be significantly different from each other?