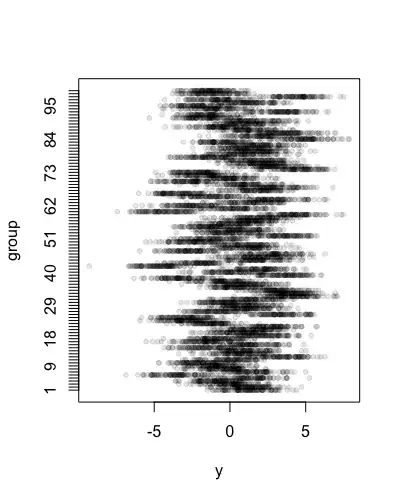

I want to do a multiple linear regression but I do not find any way to normalize the data I have. This is the distribution without transformation.

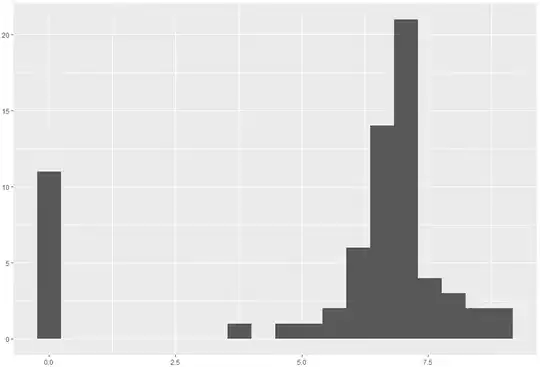

The data contains a good number of zeros. When I transformed them summing 1 and then taking the logarithm, I obtained this result:

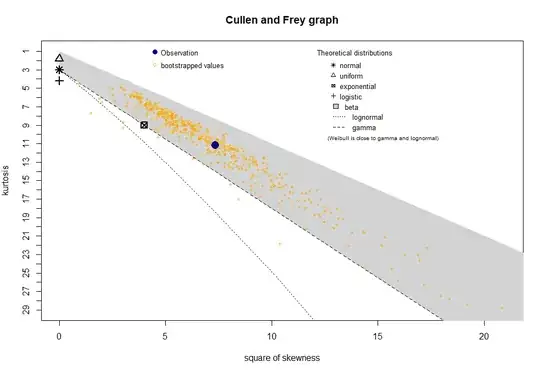

I also thought about using generalized linear models, but when I used

`descdist(data$variable, discrete = FALSE,boot=500)`

I obtained, the following graph, which I assume suggests the data follow a beta distribution, for which there are no glms for what I heard. Any suggestions? Thank you!!