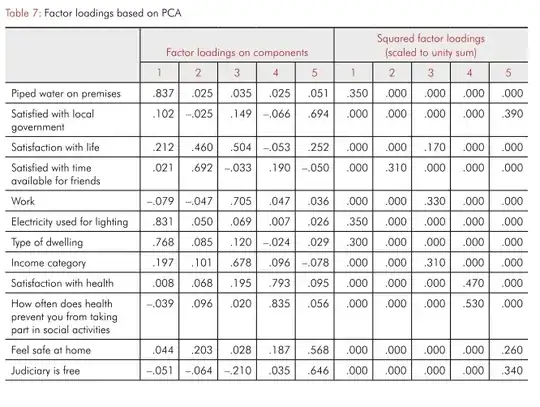

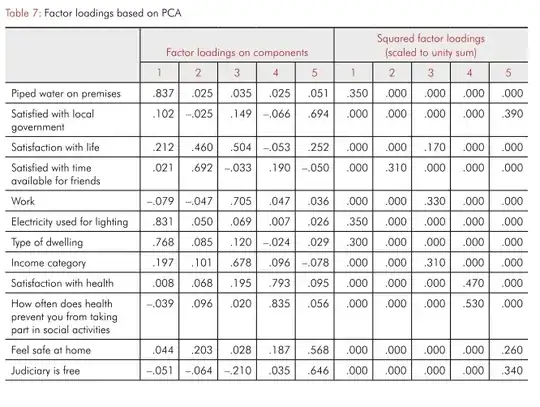

Imagine that you have 2 independent series $y_t$ and $x_t$, both random walks (non-stationary series with a unit root). You run the following regression: $y_t=\beta_1+\beta_2x_t+\epsilon_t$. Davidson & MacKinnon (see the red line in snapshot below from their textbook "Econometric Theory and Methods") did this simulation 1 million times for increasingly large sample sizes. With a sample size of 20, almost 50% of the time the t-statistic for $\beta_2$ rejected the null hypothesis $\beta_2=0$. We found a relationship that doesn't really exist because we know that $y_t$ and $x_t$ are independent by design; therefore we found a spurious relationship. What's more alarming, the larger the sample size, the higher the proportion of time that the regression result will be spurious, and this proportion converges to 1.

The phenomenon of spurious regressions is not something that afflicts non-stationary series only. Imagine repeating the above simulation, this time taking $y_t$ and $x_t$ to be independent stationary AR(1) processes with the autoregressive parameter $\rho_1=0.8$. Davidson & MacKinnon did just that; see the results depicted by the blue line. For most sample sizes, some 35% of the time we will find a spurious relationship. Fortunately, the problem does not get worse the larger the sample sizes, as it did when the 2 series were random walks. If we repeated the above experiment but this time using a lower value for the autoregressive parameter $\rho_1$ we can expect to find a lower proportion of spurious relationships. For low enough a value of the autoregressive parameter the proportion of spurious relationships should be around 0.05 (the significance level).

Whether you are looking to explain the co-movement of the 2 series, as you put it, or to predict one using the other, you will want to estimate $\beta_2$ consistently. If $y_t$ and $x_t$ are both random walks but instead of being independent (as in the first experiment above), they happen to be cointegrated then the OLS estimator of $\beta_2$ will be super-consistent (consistent and converges to the true value even faster).

So, in summary, if the 2 series are both Integrated of Order 1 and they are cointegrated, then yes you can regress one on the other to estimate their co-movement. If they are not cointegrated, you shouldn't (think of the first of the above experiments). In this case, you should difference them and regress the two in first-differences. Even then, keep in mind that if the true process (of the first-differenced series) was an AR(1) process with a root close to 1, spuriousness will still show up. Time series analysis is a tricky business.

Keep in mind that if $y_t$ is cointegrated with $x_t$ then $y_t$ will also be cointegrated with any lag of $x_t$. So, if you conclude that $x_t$ and $y_t$ are cointegrated, you are in business - and can run binary OLS regressions of $y_t$ on lagged $x_t$, and $\beta_2$ will be consistent. You can then use a fit statistic (such as $R^2$ or $AIC$) to compare the results of these binary regressions for different lags of $x_t$.