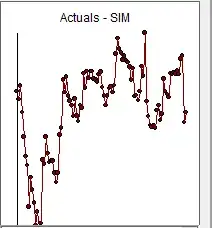

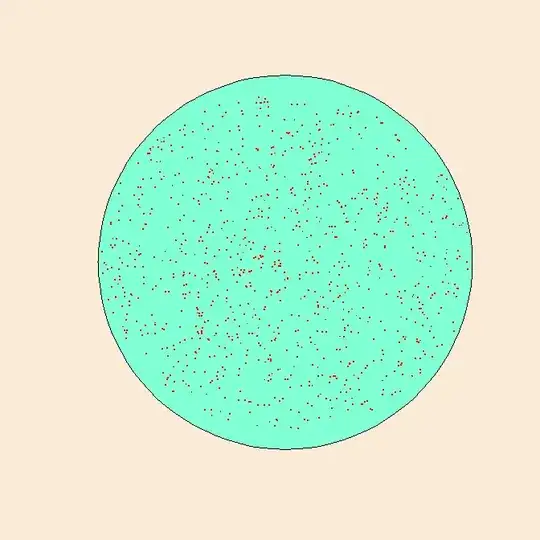

I believe I have found a paper in academia that has used a flawed multiple linear regression. I have downloaded the data set and replicated their regression results. I have done some diagnostics and have found this to my surprise:

There clearly is heteroscedasticity in the model, right? Hence, this violates the assumption of MLR that there is homoscedasticity.

Thus far I have found that heteroscedasticity has an effect on p-value, i.e. that it makes p-values for independent variables' association with dependent variable smaller. Thus, with heterscedasticity, the MLR model can show significant relationships between IVs and DVs, when in reality the significance is absent.

Is my understanding correct? Any useful resources on what heteroscedasticity entails for the MLR model's results?

Appreciate it.