I am working on this dataset.

library(Quandl)

bitcoin <- Quandl("BITSTAMP/USD",type = "xts")

bitcoin.price <- bitcoin[,"last"]

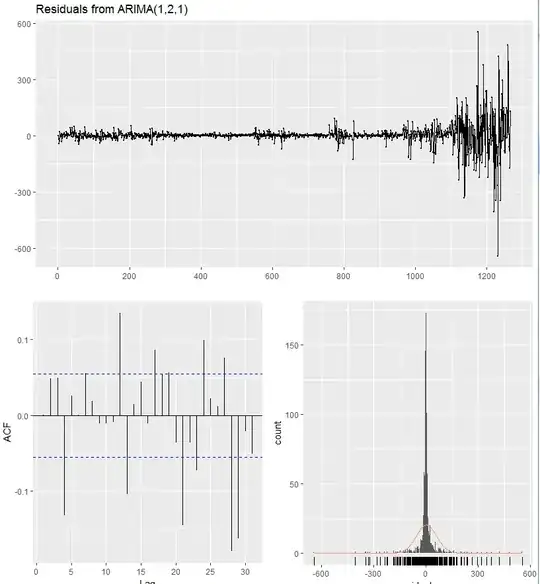

When I do NOT take logs since they have increasing variance, the model is:

ARMA(1,2,1)

with pic:

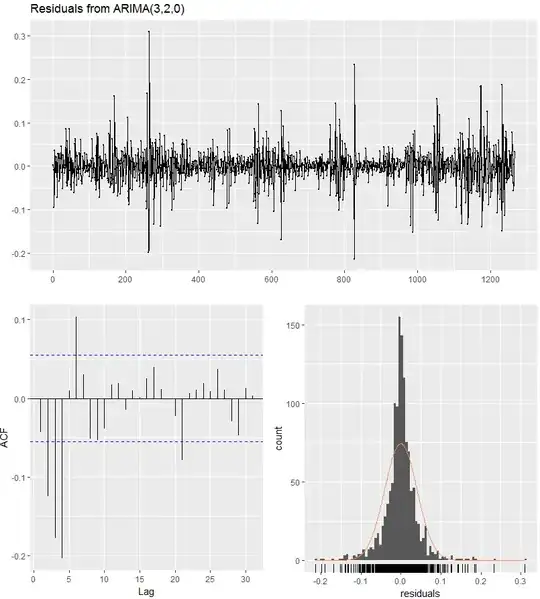

on the other hand, if I take logs, I have:

Does this make sense? Why taking logs remove the MA component?