In the textbook Econometric Analysis of Panel Data by Badi H. Baltagi is an example for a dynamic panel data analysis. It is based on the two articles:

Baltagi, Badi H., James M. Griffin, and Weiwen Xiong. "To pool or not to pool: Homogeneous versus heterogeneous estimators applied to cigarette demand." The Review of Economics and Statistics 82.1 (2000): 117-126.

Baltagi, Badi H., and Dan Levin. "Cigarette taxation: raising revenues and reducing consumption." Structural Change and Economic Dynamics 3.2 (1992): 321-335.

I am trying to replicate the results for educational reasons and to get a better understanding of the application of the GMM estimations in R and gretl. The data for the article and the example in the textbook are part of the plm package in R.

One problem I see in the presentation of the results is that there is no intercept in the estimation results, neither in the Baltagi et. al. (2000) article nor in the textbook.

My code to replicate the basic OLS regression:

library(plm)

data("Cigar")

dt.cigar <- data.table(Cigar)

dt.cigar[, `:=`(Real.Price = (price/cpi)

, Real.GDPpc = (ndi/cpi)

, Real.Price.Min = pimin/cpi)]

pdata.cigar <- pdata.frame(dt.cigar, index = c("state", "year" ))

# Pooled OLS

summary(plm(log(sales) ~ lag(log(sales), 1)

+ log(Real.Price)

+ log(Real.Price.Min)

+ log(Real.GDPpc)

# + factor(year)

, data= pdata.cigar

, model="pooling"))

Pooling Model

Call:

plm(formula = log(sales) ~ lag(log(sales), 1) + log(Real.Price) +

log(Real.Price.Min) + log(Real.GDPpc), data = pdata.cigar,

model = "pooling")

Balanced Panel: n=46, T=29, N=1334

Residuals :

Min. 1st Qu. Median 3rd Qu. Max.

-0.2077749 -0.0208569 0.0009819 0.0243556 0.2189800

Coefficients :

Estimate Std. Error t-value Pr(>|t|)

(Intercept) 0.2636862 0.0340032 7.7547 1.752e-14 ***

lag(log(sales), 1) 0.9727864 0.0062527 155.5795 < 2.2e-16 ***

log(Real.Price) -0.0829222 0.0146180 -5.6726 1.724e-08 ***

log(Real.Price.Min) 0.0160333 0.0130559 1.2280 0.2196

log(Real.GDPpc) -0.0322314 0.0062915 -5.1230 3.450e-07 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Total Sum of Squares: 67.083

Residual Sum of Squares: 2.3214

R-Squared: 0.96539

Adj. R-Squared: 0.96529

F-statistic: 9268.88 on 4 and 1329 DF, p-value: < 2.22e-16

# Within Estimator

summary(plm(log(sales) ~ lag(log(sales), 1)

+ log(Real.Price)

+ log(Real.Price.Min)

+ log(Real.GDPpc)

, data= pdata.cigar

, model="within"))

Oneway (individual) effect Within Model

Call:

plm(formula = log(sales) ~ lag(log(sales), 1) + log(Real.Price) +

log(Real.Price.Min) + log(Real.GDPpc), data = pdata.cigar,

model = "within")

Balanced Panel: n=46, T=29, N=1334

Residuals :

Min. 1st Qu. Median 3rd Qu. Max.

-1.7656e-01 -2.1815e-02 5.3382e-05 2.3558e-02 2.3979e-01

Coefficients :

Estimate Std. Error t-value Pr(>|t|)

lag(log(sales), 1) 0.8788890 0.0132688 66.2373 < 2.2e-16 ***

log(Real.Price) -0.1739878 0.0220036 -7.9073 5.632e-15 ***

log(Real.Price.Min) 0.0473236 0.0203675 2.3235 0.02031 *

log(Real.GDPpc) -0.0358652 0.0084922 -4.2233 2.577e-05 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Total Sum of Squares: 21.514

Residual Sum of Squares: 2.1669

R-Squared: 0.89928

Adj. R-Squared: 0.89543

F-statistic: 2865.95 on 4 and 1284 DF, p-value: < 2.22e-16

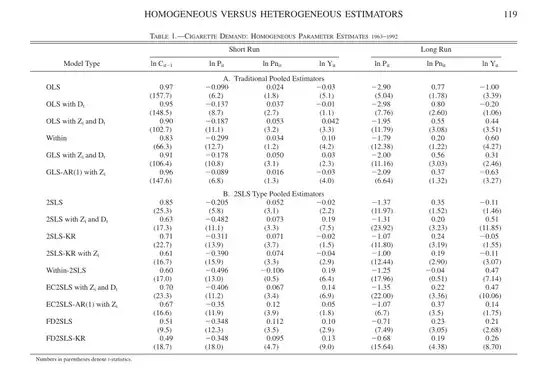

The results from the Baltagi et. al. (2000) paper look the following, although the OLS replication is pretty close it's not the same and I don't know what I am missing.

I also replicated the results with gretl and I could confirm that the R results are replicable. Does anyone have an idea where the differences might come from? Perhaps differences in the dataset, since there's none of the variables availble, which should be part of the $Z$ vector.

I also replicated the results with gretl and I could confirm that the R results are replicable. Does anyone have an idea where the differences might come from? Perhaps differences in the dataset, since there's none of the variables availble, which should be part of the $Z$ vector.