It is inherently impossible to know the probability distributions of random variables we might encounter in the "wild" -- that is the reason why researchers have to take samples.

However, since the underlying distribution is inherently a "black box", it seems like an ideal analysis would make as few assumptions about it as possible.

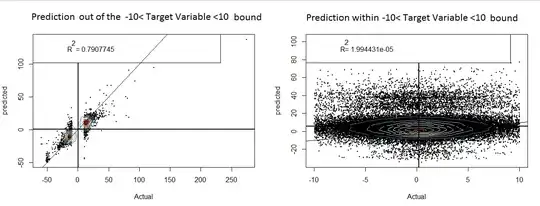

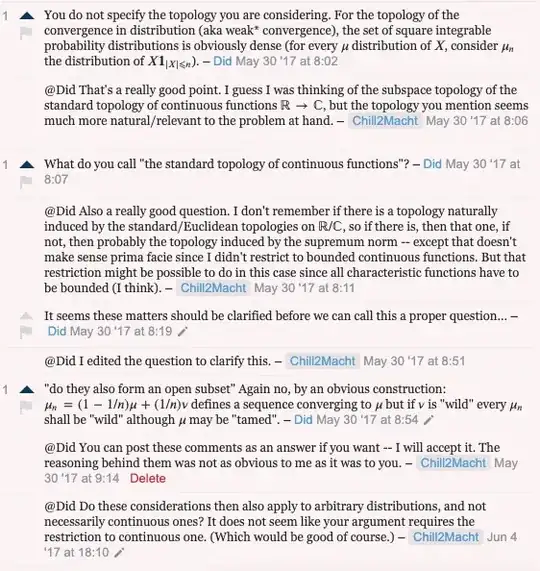

In order for the central limit theorem (CLT) to apply for i.i.d. variables following a certain distribution, it is necessary that the second moments of that distribution are finite. However, if we take a "typical" distribution, or distribution "at random", that distribution does not have finite second moments. (At least, if I interpret the comments on this question at Math.SE correctly. EDIT: this was deleted -- see below for screenshots of my stupid question and comments.)

As far as I understand, it is usually the default assumption that the CLT will hold. But combining the facts that (1) assumptions about unknown distributions should be as minimal as possible (2) the typical distribution does not satisfy the CLT, isn't this the exact opposite of what would be good?

Question: Shouldn't we assume by default, instead, that the CLT does not hold for an arbitrary unknown distribution? What is the justification for the opposite practice?

One might argue that it would be easy to identify "heavy-tailed" distributions which don't satisfy the CLT from sample data. But I don't think this is the case. Superficially, the PDF's of the normal and Cauchy distribution are both bell-shaped and look very similar. Moreover, looking at a QQ-plot for (the sample distribution of) the Cauchy distribution, it seems like a matter of luck whether we'll sample enough outliers to confirm a suspicion that the distribution is "fat-tailed", see e.g. (1)(2).

And the Cauchy distribution is just one example of a distribution which doesn't satisfy the CLT -- there are infinitely many, and in some sense "far more" such distributions than distributions which do satisfy the CLT.

I have heard that people have argued that the failure to account for fat-tailed distributions was a contributing factor to the 2008 financial crisis (1)(2), an event which obviously had a massive societal implications. Yet at least one investor website still acts as if the CLT being satisfied is a valid default assumption, despite the (1) enormously negative potential consequences for doing so, and (2) the aforementioned reasons why such a default assumption might be invalid.