Endogeneity

The macroeconomic variables you are studying are likely to affect each other. In particular, the variables on the right hand side of your model might be affected by the variable on the left hand side. That is known as the problem of endogeneity, which results in inconsistent estimates of model parameters and problems in interpreting the model.

A possible remedy to the problem is to use a (structural) VAR or (structural) VEC model that are estimated in reduced form that ensures endogeneity is not a problem. (I will not expand on how that works, but you will find plenty of material online.)

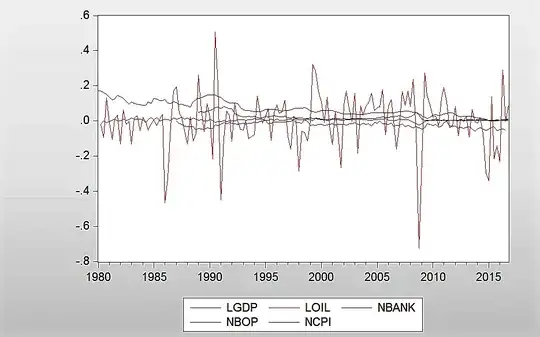

Unit roots

Are you using logged time series but not log-returns? Quite a few of the series are likely to be integrated (e.g. GPD and oil price, probably also others), which would result in nonstandard distribution of the coefficient estimates and/or the left-hand-side variable diverging from any linear combination of the right-hand-side variables.

To deal with that, you could investigate presence of cointegration and then either (in case of cointegration) proceed to VEC modelling or (in absence of cointegration) to VAR modelling on first-differenced data.

Autocorrelated errors

Another (smaller) problem might be autocorrelation in your model errors, which would lead to imprecise estimation of standard errors and statistical significance. Based on the model setup, I would guess there will be autocorrelation in the errors, and hence the problems.

That could be avoided by going for VAR or VEC model as mentioned above.

(I suppose, besides the VAR and VEC models there could be other solutions, too.

Also, there may be other problems with the model, while I am listing just the few obvious ones.)