So the most popular answer of statistics is apparently correct for this question: "it depends".

A good guess can be made about the similarity of cointegration test statistics of unique orderings of input variables, given that the time series vectors have low and similar variances.

This is implied from the calculation of the cointegration test statistic: when the variances of the input time series vectors are low and similar, the cointegration coefficients will be similar (which is to say, approximately scalar multiples of each other), resulting in the residual series being approximately scalar multiples of each other. Similar residual series implies similar cointegration test statistics. However, when the variances are large or dissimilar, there is no implied guarantee that the residual series will be even approximately scalar multiples of each other, which in turn makes the cointegration test statistics variable.

Formally:

Consider the simple regression model, used to find the cointegration coefficient for bivariate cases.

Regressing x on y: $$ \hat{\beta}_{xy} = {Cov[x,y] \over \sigma_x^2 } $$

Regressing y on x: $$ \hat{\beta}_{yx} = {Cov[y,x] \over \sigma_y^2 } $$

Clearly $Cov[x,y] = Cov[y,x]$.

But, generally, $ \sigma^2_x \neq \sigma^2_y $.

Thus, $ \hat{\beta}_{xy} $ is not a scalar multiple of $ \hat{\beta}_{yx} $.

So the linear combinations (AKA residual series) that are used to test for a unit root to determine likelihood of cointegration are not scalar multiples of one another: $$ x_t - \gamma^1 y_t = \epsilon_t^1 $$ $$ y_t - \gamma^2 x_t = \epsilon_t^2 $$

Note that, therefore, $ \gamma = \hat{\beta} $, so generally $ \gamma^1 \neq a*\gamma^2 $ for some scalar $a$.

This shows two facts about cointegration:

- The variable order in testing for cointegration matters because of the variance of the individual time series vectors. This affects the relationship between the cointegration coefficients of the various variable orientations because of how the cointegration coefficient is calculated.

- The residual series may or may not be "similar" to one another: the similarity depends on the variances of the individual time series vectors.

These facts imply that the residual series formed by unique variable orderings are not only different, but they are probably not scalar multiples of one another.

So which ordering to choose? It depends on the application.

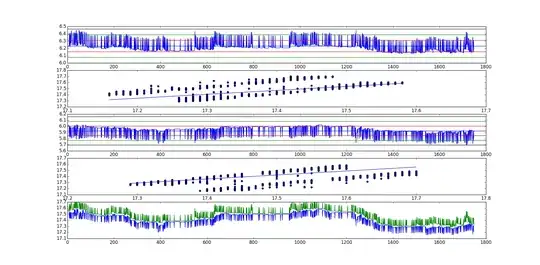

Why do some residual series as generated from the same data series but different orderings appear similar while others appear so different? It is because of the variance of the individual time series vectors. When the time series vectors have similar variance (as is certainly possible when comparing similar time series data), the residual series may seem like $-1 * \alpha$ multiples of one another, with $\alpha$ being some scalar value. This is the case when the variance of the time series vectors are both low and similar, resulting in similar error terms in the linear combinations.

So, finally, if the time series vectors that are being tested for cointegration have low and similar variances, then one can correctly suppose that the cointegration test statistic will be of a similar confidence level. In general, it is probably best to test both orientations, or at least consider the variances of the time series vectors, unless there is a prevailing reason to favor one orientation.