I got a time series dataset from the lab and would like to fit my data to a curve (using R package): $$ P_{1}(t)=y_{0}-a_{1}e^{-b_{1}t}-a_{2}e^{-b_{2}t}, b_{2}>b_{1} \tag{A} $$

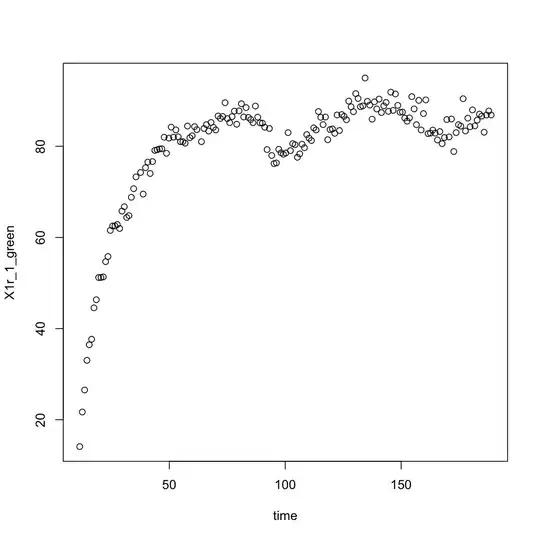

I plotted the data:

I think I need to start with good initial values to get a better estimate when fitting to the curve.So I start with a simpler curve: $$ P_{2}(t)=a_{1}e^{-b_{1}t} \tag{B} $$

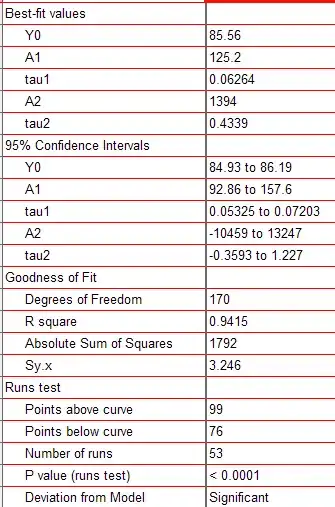

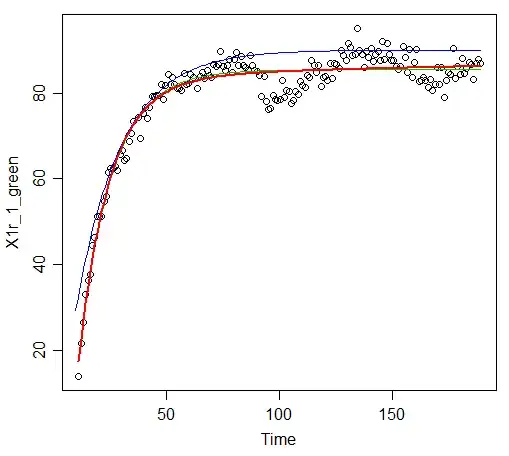

and I got:

Call:

lm(formula = log(P1_1) ~ time)

Coefficients:

(Intercept) time

4.084148 0.002703

That is, $a_{1}=54, b_{1}=0.003$ (roughly).

So I set the starting value $y_{0}=30, a_{1}=20, b_{1}=0.002, b_{1}=30, b_{2}=0.003$ and then did:

nls_fit <- nls(X1r_1_green~-y0+A1*exp(tau1*Time)+A2*exp(tau2*Time),

start=list(y0=35, A1=20, A2=30, tau1=.02, tau2=.03), data=data1, trace=T)

However, it returns errors that I could not figure out how to fix, such as:

step factor 0.000488281 reduced below 'minFactor' of 0.000976562

singular gradient matrix at initial parameter estimates

After digging into some posts online, the error might be the poor initial values. After many times attempts at different initial values I've still had no luck, though. Do you have any suggestions?

The data is as follows:

Time X1r_1_green

1 11.333 14.1060

2 12.443 21.6894

3 13.450 26.5231

4 14.457 33.0356

5 15.463 36.4517

6 16.471 37.6585

7 17.478 44.5417

8 18.485 46.3301

9 19.492 51.2111

10 20.499 51.2094

11 21.505 51.3405

12 22.513 54.6848

13 23.520 55.8172

14 24.527 61.5436

15 25.534 62.5158

16 26.541 62.5279

17 27.547 62.8395

18 28.555 61.9790

19 29.562 65.7806

20 30.569 66.7353

21 31.576 64.3837

22 32.583 64.7834

23 33.589 68.8058

24 34.597 70.6975

25 35.604 73.2809

26 37.597 74.2578

27 38.707 69.5155

28 39.714 75.3023

29 40.721 76.5360

30 41.727 74.0348

31 42.735 76.6561

32 43.742 79.1025

33 44.749 79.2463

34 45.756 79.4334

35 46.763 79.4644

36 47.769 81.9903

37 48.776 78.4627

38 49.784 81.7913

39 50.791 84.2073

40 51.798 82.0027

41 52.805 83.6003

42 53.811 82.0862

43 54.818 80.9991

44 55.826 81.0088

45 56.833 80.6877

46 57.840 84.4431

47 58.847 81.8827

48 59.853 82.3165

49 60.861 84.3172

50 61.868 83.6584

51 63.862 81.0175

52 64.972 83.9112

53 65.979 84.7511

54 66.986 83.3383

55 67.993 85.2289

56 68.999 84.1657

57 70.007 83.5959

58 71.014 86.6437

59 72.021 86.1192

60 73.028 86.5437

61 74.034 89.5566

62 75.041 86.0854

63 76.049 85.1923

64 77.056 86.5120

65 78.063 87.7273

66 79.070 84.8408

67 80.076 87.7706

68 81.083 89.3330

69 82.091 86.4411

70 83.098 88.4944

71 84.105 86.3283

72 85.112 85.8619

73 86.118 85.1758

74 87.125 88.8349

75 88.133 86.4028

76 89.140 85.1487

77 90.147 85.0808

78 91.154 84.1891

79 92.160 79.2782

80 93.167 83.9142

81 94.175 77.9845

82 95.182 76.1993

83 96.189 76.3565

84 97.196 79.3567

85 98.202 78.5809

86 99.210 78.2514

87 100.217 78.5353

88 101.224 82.9957

89 102.231 79.0445

90 103.237 80.5854

91 104.244 80.3490

92 105.252 77.5888

93 106.259 78.3460

94 107.266 80.4607

95 108.273 79.6868

96 109.279 82.5708

97 110.287 81.7843

98 111.294 81.2645

99 112.301 84.0419

100 113.308 83.5896

101 114.315 87.6291

102 115.321 86.3707

103 116.329 84.7563

104 117.336 86.4180

105 118.343 81.4442

106 119.350 83.6793

107 120.357 83.8090

108 121.363 82.8488

109 122.371 86.8810

110 123.378 83.4640

111 124.385 86.9706

112 125.392 86.5779

113 126.398 85.8226

114 127.406 89.9185

115 128.413 88.6702

116 129.420 87.5920

117 130.427 91.5657

118 131.434 90.5003

119 132.440 88.6852

120 133.448 88.8704

121 134.455 94.9899

122 135.462 89.8719

123 136.469 89.0472

124 137.477 85.9579

125 138.483 89.7549

126 139.490 88.1925

127 140.497 90.3598

128 141.504 87.4038

129 142.511 88.8794

130 143.518 89.6318

131 144.525 87.6712

132 145.532 91.8890

133 146.539 87.8800

134 147.546 91.4838

135 148.553 88.9816

136 149.560 87.4804

137 150.567 87.5171

138 151.574 86.1898

139 152.581 85.5146

140 153.588 86.2422

141 154.595 90.9029

142 155.602 88.2005

143 156.609 84.7370

144 157.616 90.0859

145 158.623 83.5787

146 159.630 87.1796

147 160.637 90.1887

148 161.644 82.7800

149 162.651 82.8887

150 163.658 83.5638

151 164.665 82.8934

152 165.672 81.3959

153 166.679 83.2340

154 167.686 80.5834

155 168.693 81.9224

156 169.700 85.8687

157 170.707 82.0637

158 171.714 85.9917

159 172.722 78.8532

160 173.728 83.0037

161 174.735 84.7516

162 175.742 84.4288

163 176.749 90.4443

164 177.757 83.3640

165 178.764 86.1808

166 179.770 84.2887

167 180.777 87.9906

168 181.784 84.4754

169 182.791 85.7398

170 183.798 87.0640

171 184.805 86.6323

172 185.812 83.0898

173 186.819 86.8609

174 187.826 87.7454

175 188.833 86.8763