So I have been doing some research on how to implement a linear regression forecast with diminishing returns

I've been looking through a number of other articles and have come across several different (possible?) solutions

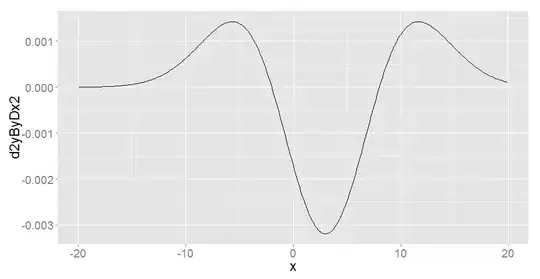

1.) include the squares of variables Why is functional form so important when specifying models?

2.) fit the best model and obtain the first derivative Whether to include $x$ and $x^2$ in regression model examining diminishing returns when only $x^2$ is significant?

3.) Use a linear-log transformation for all variables http://www.dummies.com/how-to/content/the-linearlog-model-in-econometrics.html

Not truly sure which method is best, or honestly how each work so would be very grateful for a working example. I have provided some fake data below...

Period Budget Ad Space

1 100 100

2 200 200

3 300 300

4 400 375

5 500 450

6 600 500

7 700 550

8 800 575

9 900 600

10 1000 ?

11 1100 ?

12 1200 ?

13 1300 ?

14 1400 ?