You are attempting to forecast a compositional time series. That is, you have three components that are all constrained to lie between 0 and 1 and to add up to 1.

You can address this issue using standard exponential smoothing, by using an appropriate generalized logistic transformation. There was a presentation on this by Koehler, Snyder, Ord & Beaumont at the 2010 International Symposium on Forecasting, which turned into a paper (Snyder et al., 2017, International Journal of Forecasting).

Let's walk though this with your data. Read the data into a matrix obs of time series:

obs <- structure(c(0.03333333, 0.03810624, 0, 0.03776683, 0.06606607,

0.03900325, 0.03125, 0, 0.04927885, 0.0610687, 0.03846154, 0,

0.06028636, 0.09646302, 0.04444444, 0.01111111, 0.02309469, 0.03846154,

0.03119869, 0.01201201, 0.02058505, 0.015625, 0, 0.01802885,

0.02290076, 0, 0, 0.03843256, 0.05144695, 0.06666667, 0.9555556,

0.9387991, 0.9615385, 0.9310345, 0.9219219, 0.9404117, 0.953125,

1, 0.9326923, 0.9160305, 0.9615385, 1, 0.9012811, 0.85209, 0.8888889

), .Dim = c(15L, 3L), .Dimnames = list(NULL, c("Series 1", "Series 2",

"Series 3")), .Tsp = c(1, 15, 1), class = c("mts", "ts", "matrix"

))

You can check whether this worked by typing

obs

Now, you have a few zeros in there, which will be a problem once you take logarithms. A simple solution is to set everything that is less than a small $\epsilon$ to that $\epsilon$:

epsilon <- 0.0001

obs[obs<epsilon] <- epsilon

Now the modified rows do not sum to 1 any more. We can rectify that (although I think this might make the forecast worse):

obs <- obs/matrix(rowSums(obs),nrow=nrow(obs),ncol=ncol(obs),byrow=FALSE)

Now we transform the data as per page 35 of the presentation:

zz <- log(obs[,-ncol(obs)]/obs[,ncol(obs)])

colnames(zz) <- head(colnames(obs),-1)

zz

Load the forecast package and set a horizon of 5 time points:

library(forecast)

horizon <- 5

Now model and forecast the transformed data column by column. Here I am simply calling ets(), which will attempt to fit a state space exponential smoothing model. It turns out that it uses single exponential smoothing for all three series, but especially if you have more than 15 time periods, it may select trend models. Or if you have monthly data, explain to R that you have a potential seasonality, by using ts() with frequency=12 - then ets() will look at seasonal models.

baz <- apply(zz,2,function(xx)forecast(ets(xx),horizon=horizon)["mean"])

forecasts.transformed <- cbind(baz[[1]]$mean,baz[[2]]$mean)

Next we backtransform the forecasts as per page 38 of the presentation:

forecasts <- cbind(exp(forecasts.transformed),1)/(1+rowSums(exp(forecasts.transformed)))

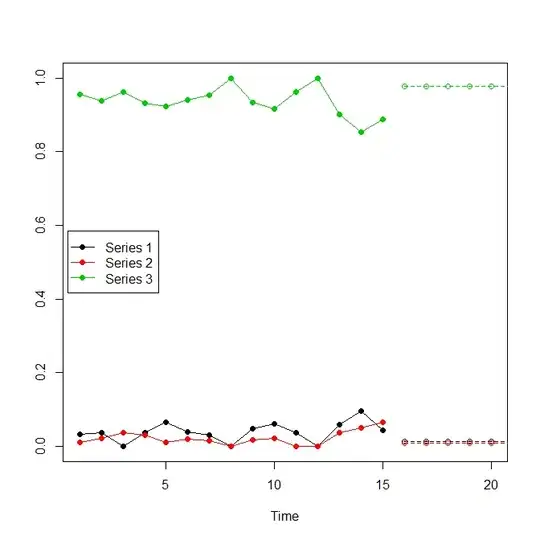

Finally, let's plot histories and forecasts:

plot(obs[,1],ylim=c(0,1),xlim=c(1,nrow(obs)+horizon),type="n",ylab="")

for ( ii in 1:ncol(obs) ) {

lines(obs[,ii],type="o",pch=19,col=ii)

lines(forecasts[,ii],type="o",pch=21,col=ii,lty=2)

}

legend("left",inset=.01,lwd=1,col=1:ncol(obs),pch=19,legend=colnames(obs))

EDIT: a paper on compositional time series forecasting just appeared. I haven't read it, but it may be of interest.