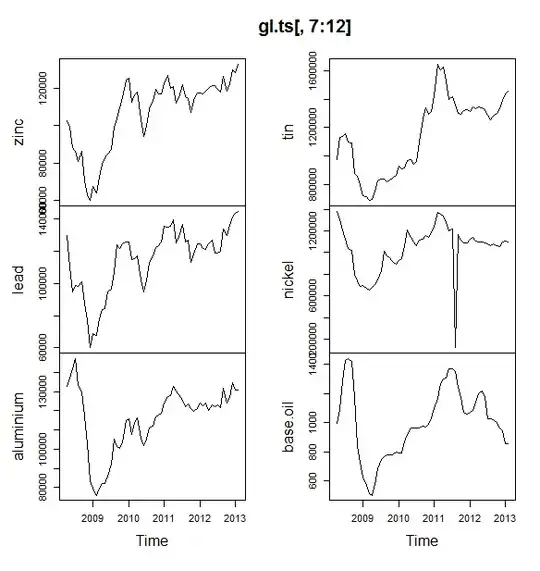

I am trying to forecast commodity price fluctuations in a small dataset. The data I am using is here .

- Does my data have seasonality and Trend? Can someone explain me how to decide that?

- If my data does not have any proper trend or seasonality, I think the best way is to use Cointegration method to predict fluctuations together(A drunk and her dog)

- Is there any other way I can make reasonable forecast or is this data forecastable?

The price drop in 2008 is due to the Global Energy Crisis (Wikipedia)

Also please refer to my old question .Thanks to all the people who explained me in detail!

To predict Cointegration using ADF, I put together the below R function

cointegration<-function(x,y)

{

m<-lm(x~y+0,data=gl.full)

beta <- coef(m)[1]

sprd <- x - beta*y

ht<-adf.test(sprd,alternative="stationary",k=0)

if (ht$p.value < 0.05)

{

cat(paste("P Value:", ht$p.value,"The spread is likely mean-reverting(Co-integrated).\n"))

} else

{

cat(paste("P Value:", ht$p.value,"The spread is not mean-reverting(Not Co-integrated).\n"))

}

}

And I call it like this cointegration(gl.full$base.oil,gl.full$hr.coil)

Please let me know if I am in the right track.