There's no one 'best distribution' for these things; the specifics are impacted by so many different things, so there's no 'simple' form that will be quite right, it's a matter of whether you can get a satisfactory approximation (though in many cases you don't need to identify a specific distribution, it depends on what questions you're trying to answer).

There's whole books* dealing with loss distributions, so I can't hope to give a comprehensive list and discuss the various characteristics.

A few commonly used distributions in various situations include gamma, lognormal, inverse Gaussian, Pareto, log-logistic - and truncated (or sometimes, censored) versions of each of those in some cases (e.g. fixed deductibles lead to truncation). You see many other distributions as well. In practice, the payments are a mixture of different risk classes, with different loss-size characteristics, and none of those are especially suitable in many cases.

Where sums-insured tend to occur at round numbers (though the losses might not be round numbers), mixture distributions might be used.

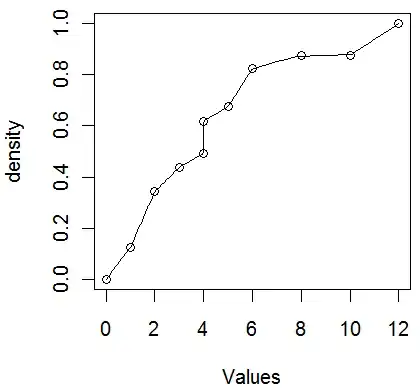

A first thing to do might be to take logs, and see what that looks like. But if you're going to use a histogram, use more classes! If you use only a few classes for a histogram with data that tends to be a bit clumpy, you can get some very different impressions, depending on your choices of class width and class origin, in extreme cases, even to looking either left skew or right skew with only slightly different choices.

* For example:

R. V. Hogg and S. A. Klugman (1984),

Loss Distributions

Wiley, New York.

ISBN 0-4718792-9-0

S. A. Klugman, H. H. Panjer, and G. Willmot (2004),

Loss Models: From Data to Decisions

Wiley, New York, 2nd Ed.

ISBN 0-4712157-7-5