I am performing survival analysis on credit data. I created a simple model with using interest rate:

cox <- coxph(Surv(periods,charged_off) ~ int_rate, data=notes)

I assumed that int_rate was a time-independent variable, but the following test rejects HA:

> cox.zph(cox)

rho chisq p

int_rate 0.0446 14.2 0.000169

Same result for other variables such as loan amount:

> cox <- coxph(Surv(periods,charged_off) ~ int_rate + loan_amnt, data=notes)

> cox.zph(cox)

rho chisq p

int_rate 0.0364 9.31 2.28e-03

loan_amnt 0.0317 8.84 2.95e-03

GLOBAL NA 26.28 1.97e-06

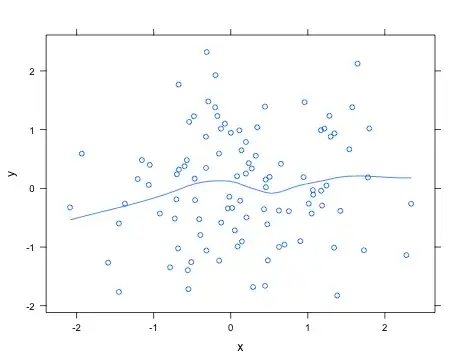

Plot for int_rate:

Why would these covariates be considered time dependent? Am I doing something wrong? Thanks.