I am trying to model sales as a function of various variables (debt, number of employees, competitors etc.). For this I have transformed both dependent and independent variables using natural logarithm.

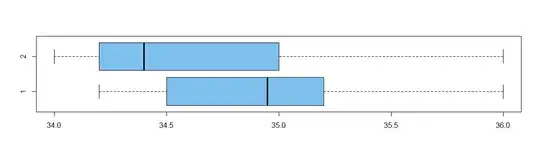

The problem is the residuals are not normal as indicated by both their plot and the Shapiro-Wilk test.

I imagine that the log transform can also affect the residuals: could this explain their lack of normality?

Other model stats are looking good, R2 adjusted = 0.92, F test is significant, Resid Std Err = 0.5, and the mean of residuals is 0.

Edit:

Size of dataset: N = 4403; 8 variables in the model: 3 continuous, 5 discrete