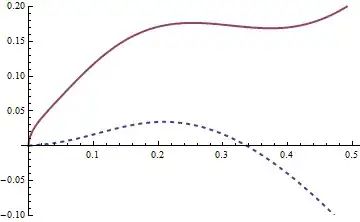

How to identify autocorrelation of residuals in the fitted VAR model. I have provided the ACF and PACF plots below. There are some significant lags in the PACF plot. Does it mean that my model has autocorrelated residuals and not adequate?

Asked

Active

Viewed 60 times

0

Geek_Tech

- 99

- 1

- 8

-

Your title does not quite seem to match the body. – Richard Hardy Dec 14 '21 at 19:43

-

How many observations do you have? More than 400 hopefully. If you have only 110 observations then your $\hat\rho(100)$ was computed using only 10 pairs of observations. A rule of thumb is to produce ACF for a number of lags that is

– ColorStatistics Jan 06 '22 at 12:06

1 Answers

2

These plots look pretty decent to me. I would not expect better behavior even if the model happened to coincide with the true DGP. (You could simulate from the estimated model, fit the model on the simulated data and inspect its residuals to see for yourself.)

Take a look at cross correlations for lag$\neq 0$, too. Given a statistically adequate model, most of them should also be insignificant.

Richard Hardy

- 54,375

- 10

- 95

- 219

-

thanks for your answer. Can I use Ljung Box test instead of using ACF and PACF plots, – Geek_Tech Dec 15 '21 at 05:36

-

1@Geek_Tech, people do that, though I am not sure if it is a valid approach; see ["Testing for autocorrelation: Ljung-Box versus Breusch-Godfrey"](https://stats.stackexchange.com/questions/148004) which may apply for VAR models, too. Perhaps there is a multivariate version of the LB test. I would look for it in Tsay "Analysis of Financial Time Series" (it also comes with an accompanying R package). – Richard Hardy Dec 15 '21 at 06:13