I'm curious about how a Frequentist would approach an optimization problem, where said problem is constructed using inferred parameters. As an example, I'll use price optimization given a demand curve. $Revenue(x) = Price * Volume$. Let's assume my demand curve follows exponential decay.

- Infer demand curve parameters

- Maximize $Revenue(X)$

I can perform linear regression, given price and the log of the sales volume, to infer the slope and intercept. Using a Bayesian approach, I'll have a posterior chain to sample from. So, if I have 4000 samples in my posterior chain, I can uniformly draw indices in the range [1, 4000], and retrieve their corresponding slope and intercept values then use them to visualize my revenue function.

Big edit: Code included

- simulate data

sd = 0.5

m,b = -0.25, 5

X = np.linspace(0,20,100)

Y = np.exp(np.random.normal(loc=m*X+b, scale=sd))

plt.scatter(X,Y)

- Model w/ PyMC3

with pm.Model() as model:

m = pm.Normal('m',mu=0, sd=2)

b = pm.Normal('b',mu=0, sd=2)

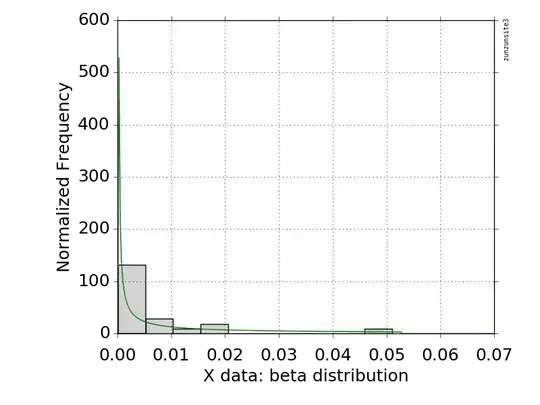

s = pm.Exponential('s',lam=1)

y_hat = pm.math.dot(m, X) + b

lik = pm.Normal('lik', mu=y_hat, observed=pm.math.log(Y), sigma=s)

trace = pm.sample(chains=4)

- plot posterior-predictive distribution

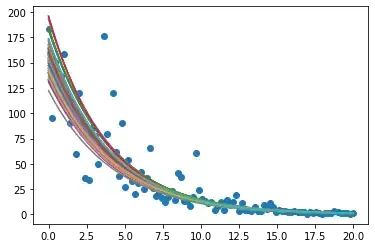

def post_plot(trace_obj=trace,samples=100,size=len(X)):

for itr in range(samples):

idx = random.choice(range(size))

m = trace_obj.get_values('m')[idx]

b = trace_obj.get_values('b')[idx]

Y_hat = np.exp(m*X + b)

plt.plot(X,Y_hat)

plt.scatter(X,Y)

post_plot()

- Posterior predictive revenue

def rev_posterior(samples=100, size=len(X)):

for s in range(samples):

idx = random.choice(range(size))

m = trace.get_values('m')[idx]

b = trace.get_values('b')[idx]

rev = X * np.exp(m*X +b)

plt.plot(X, rev)

return

rev_posterior()

This is useful in two ways: (A) I can see the variance around the sales volume at the optimal price. And (B) I can see that each sampled function has a peak around the same spot; in other words, there's very little variance around where the optimal price is located.

My actual question: Using parameter estimates and confidence intervals, how might a Frequentist construct a similar revenue function plot? I understand that they could simply use the point estimates of the slope and intercept and then find a point estimate of the optimal price, but I'm curious about the variance around the optimal value.

For the code that simulated this data, generated this plot, and Bayesian model that inferred the posterior distribution, see here