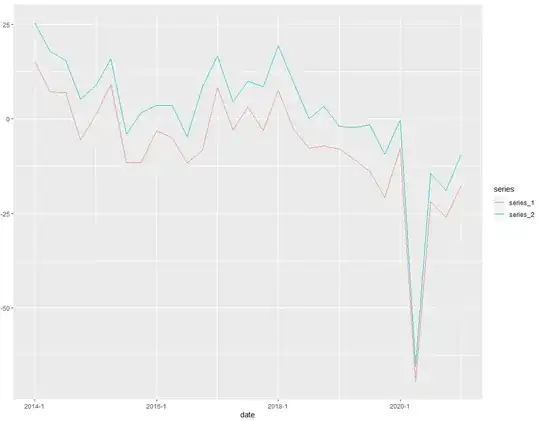

Every quarter, we ask around 2500 companies about their business situation. The possible answers are good (+1), normal (0) or bad (-1). The answers are, then, aggregated to an index (series_1) (The index corresponds to the simple arithmetic mean of all answers multiplied by a factor of 100). In additon, we calculated the same index for a subsector (series_2).

What I am trying to find out is which test I can use to test whether the two time series are statiscally different from each other.

Although I googled a lot, I could not find a statistical test to answer my question. So, any help is greatly appreciated.