Proving the pre-trend parallel is hard in generalized DiD. From this post, Thomas Bilach suggests me a very excellent way to do so which is called "coefficient plotting"

In short, it can be achieved by running this equation

$$y_{kt} = \alpha_k + \lambda_t + \delta_{-2} d_{k,t-2} + \delta_{-1} d_{k,t-1} + \delta d_{kt} + \delta_{+1} d_{k,t+1} + \delta_{+2} d_{k,t+2} + \delta_{+\bar{3}} d_{k,t+\bar{3}} + \epsilon_{kt}$$

And then, we will see "how close the $\delta$ to 0" for pre-trend periods if I understand correctly. Some examples can be seen in the answer of @Thomas Bilach above.

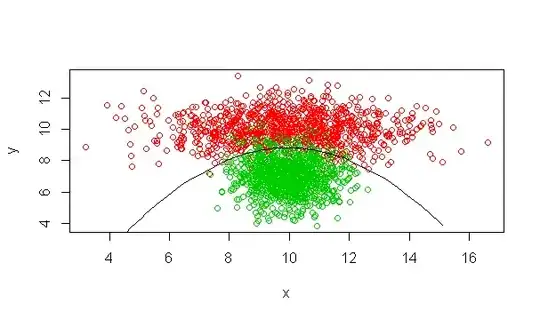

My effort is that I try to mimic what @Thomas Bilach suggests, along with adding some more covariates (independent variables). However, my result is as below, which make me feel hard in explaining regarding "how close to 0"

For example, I run such regression for two different dependent variables called $y1_{kt}$ $y2_{kt}$

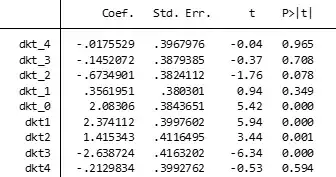

The results for is $y1_{kt}$

While dkt_4 is $d_{k,t-4}$, dkt4 is $d_{k,t+4}$ As can be seen, p-value of dkt1 is higher than 0.1, insignificant, so whether we still plot the coefficient even it is insignificant.

Apart from that, from the result above, is there any conclusion about the impact of laws on the dependent variable $y1_{kt}$ why the lead indicators seem to be smaller than that of lad indicators?

The result for $y2_{kt}$

How can we explain the stability trend in this case?