This is a visual answer: a careful consideration of the second figure shows what is going on. Everything else in this post is only a gloss on that figure.

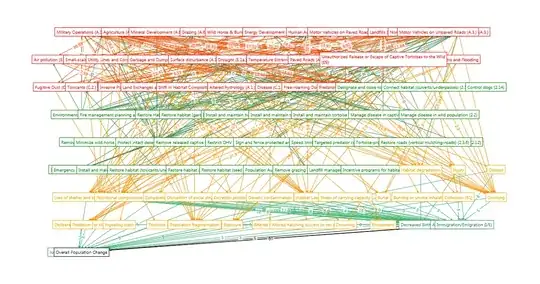

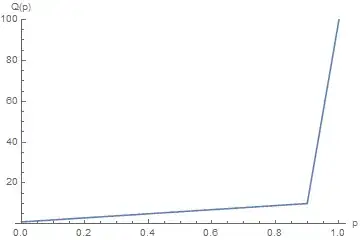

In this figure of the $(x,y)$ plane, region $I$ (blue, top) consists of all $y$ values exceeding a quantile $Q_{90}(Y),$ region $II$ (red, right) consists of all $x$ values exceeding a quantile $Q_{90}(X),$ and therefore their intersection (purple, top right) shows all points $(x,y)$ where both $x\ge Q_{90}(X)$ and $y \ge Q_{90}(Y).$

This figure has been drawn to scale, so that the line $x+y=Q_{90}(X)+Q_{90}(Y)$ will make an angle of $-45$ degrees, it will pass through the central point $(Q_{90}(X), Q_{90}(Y)),$ and all points $(x,y)$ whose sum exceeds this threshold will lie to the upper right of that line:

The question wonders about the circumstances that would permit the probability of the combined three regions $B\cup C \cup D$ to exceed $100\%-90\%,$ for then the $90^\text{th}$ quantile of $X+Y$ would have to lie even further above and to the right.

This way of reframing the question makes the answer generally clear, whether or not $X$ and $Y$ are independent: we need only concentrate most of the probability from regions $I\cup II,$ as colored in the first figure, within the three regions $B\cup C\cup D$ (that green triangle in the second figure).

When $X$ and $Y$ are independent it's a little tricky to do that, because independence implies $$\Pr(C) = \Pr(I\cap II) = \Pr(I)\Pr(II) = (1-0.9)(1-0.9) = 0.01,$$ severely limiting how much probability we can assign to $C.$ Observe, though, that including $B$ and $D$ can greatly increase the probability of $B\cup C\cup D.$ If we make sure most of the probability of the events $I$ and $II$ is located way above and way to the right (respectively), then $B \cup C$ can include almost all of the probability of $I.$ That is, we can make $\Pr(B\cup C) \le 1 - 0.9=0.1$ arbitrarily close to $0.1$ and likewise we can make $\Pr(D\cup C)$ arbitrarily close to $0.1.$ Consequently we obtain the bounds, which clearly can be approached as nearly as we might desire, of

$$\Pr(B\cup C\cup D) = \Pr(B\cup C) + \Pr(D\cup C) - \Pr(C) \le 0.1 + 0.1 - 0.01 = 0.19.$$

These considerations lead immediately to a simple example: let's put atoms at appropriate places within the figure. For instance, at the places where the symbols "A" through "E" are drawn, assign concentrated probabilities symmetrically in $x$ and $y$ as follows by choosing an arbitrarily tiny positive $\epsilon:$

$$\cases{A: 0 \\ B: 1-0.9-\epsilon\approx 0.1 \\ C: (1-0.9)^2=0.01 \\ D: 1-0.9-\epsilon\approx 0.1 \\E: 0}$$

and distribute the rest of the probability to the left and below everything else, again symmetrically, so that $X$ and $Y$ have identical and independent distributions.

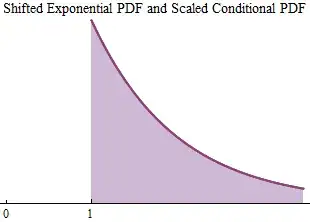

Notice this says almost nothing about how heavy the tail of this common distribution might be! In the example, this distribution could have an upper limit just barely greater than $Q_{90}.$