I am trying to understand the concept of ARCH(1) model from this tutorial video.

From 4:15, it's explained that,

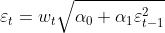

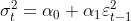

the variance of residuals (1) can be formulated as (2).

( = residual at t,

= residual at t,  =variance of residual(volatility) at t, w=white noise)

=variance of residual(volatility) at t, w=white noise)

(1)

(1)

(2)

(2)

However, as wiki says,

ARCH model ... describes the variance of the current error term or innovation as a function of the actual sizes of the previous time periods' error terms

and the variance of residuals can be written as (3).

(3)

(3)

I am very confused because what wiki says seems to contradict with what's explained in the said video.

(1) seems to correspond with the fact that ARCH model takes into account the previous volatility(variance of residuals).

(3) seems to correspond with the fact that ARCH model takes into account the previous time period's error terms (residuals).

Could anyone clarify how the (1) is re-formulated to (2) mathematically?

Also please tell me if there's anything that I seem to misunderstand.

Really appreciate your help.