I am facing some difficulties understanding this question. It hasn't been long since I started with econometrics, so I'm new to all of this.

Suppose we have a function $$E[c_t|y_t,c_{t-1},y_{t-1},c_{t-2},...]=\alpha +\gamma y_t +\delta c_{t-2}$$ that is estimated using OLS. Assume that $c_t$ and $y_t$ are stationary and ergodic. Is it neccessary using HAC variance estimation to construct standard errors?

I understand that HAC is used when the error term is serially correlated, but I don't know what steps are needed to start this problem?

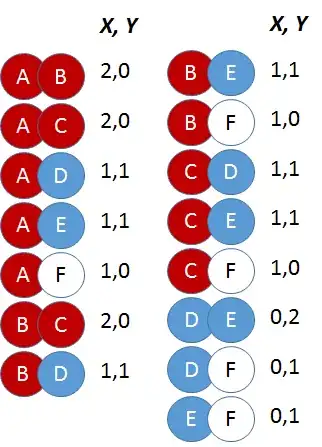

One of my friend's solution

But apparently, the suggested answer is: The regressors $y_t$ and $c_{t-2}$ are inside the conditional set. Therefore, it is a proper time series regression and OLS is consistent. The immediate past of left side variable $y_t$ is inside the conditional set. Therefore, there is no serial correlation in the error term and HAC is not needed