Models provided below.

My questions are:

1.

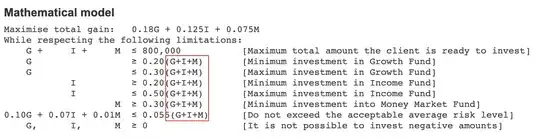

(G+I+M) after each constraint in the screenshot of the mathematical model below represents Growth, Income and Money Market Funds, but does that mean for example, G >= 0.20 multiplied by (G+I+M)?

2.

Much less stable figures for the forecast net yields are 18%, 12.5%, and 7.5%.

Those three yield values make up the OF, but what's the significance of saying "Much less stable figures..."?

3.

Suggesting the investment plan with a slightly lower or slightly larger risk level is acceptable.

Am I supposed to create second/third models with lower/higher risk levels than 5.5% for testing? Or am I meant to use the sensitivity reports to figure that out?

Problem

Diversification strategy requires any portfolio to be split across three different mutual funds while respecting the following limits:

Between 20% and 30% to be allocated within Growth Fund

Between 20% and 50% to be allocated within Income Fund

No less than 30% to be allocated within Money Market Fund

Current estimates of the risk factors are:

10% for the Growth Fund

7% for the Income Fund

1% for the Money Market Fund

Much less stable figures for the forecast net yields are estimated to be:

18% for the Growth Fund

12.5% for the Income Fund

7.5% for the Money Market Fund

Client is willing to invest up to £800,000. Client risk profile indicates an average risk level of 5.5%. Suggesting the investment plan with a slightly lower or slightly larger risk level is acceptable.

A mathematical model formulated for this problem using 5.5% as the maximum acceptable average risk level is shown below.

Lindo gives syntax error when writing (G+I+M).

MAX TtlGain) 0.18G + 0.125I + 0.075M

SUBJECT TO

MaxInv) G + I + M <= 800000

MinInvGF) G >= 0.20(G+I+M)

MaxInvGF) G <= 0.30(G+I+M)

MinInvIF) I >= 0.20(G+I+M)

MaxInvIF) I <= 0.50(G+I+M)

MinInvMMF) M >= 0.30(G+I+M)

AvRskLvl) 0.10G + 0.07I + 0.01M <= 0.055(G+I+M)

END

Final - it seems Lindo/Lingo solution output is better with transformations using <= rather than >=. The solution for both is the same but the sensitivity report does not contain negatives when using <=. I might post another question asking about that.

MAX TtlGain) 0.18G + 0.125I + 0.075M

SUBJECT TO

MaxInv) G + I + M <= 800000

MinInvGF) -0.80G + 0.20I + 0.20M <= 0

MaxInvGF) 0.70G - 0.30I - 0.30M <= 0

MinInvIF) -0.80I + 0.20G + 0.20M <= 0

MaxInvIF) 0.50I - 0.50G - 0.50M <= 0

MinInvMMF) -0.70M + 0.30G + 0.30I <= 0

AvRskLvl) 0.045G + 0.015I - 0.045M <= 0

END