Suppose $Z \sim \mathcal{N}(0,1)$.

Suppose $X$ is a lognormally distributed random variable, defined as $X:=X_0exp^{(-0.5\sigma^2+\sigma Z)}$, in other words, $X$ is log-normal with $\mathbb{E}[X]=X_0$.

Suppose we are interested in the variable of the type $Y:=\frac{1}{1+X}$

Question: Does the distribution of $Y$ have any name? Does it have a well defined PDF and CDF?

Distributions such as $Y$ arise often in finance, because interest rates might be modelled as exponential martingales (i.e. their distribution at a specific point in time would correspond to the variable $X$ defined above). Then, Bond prices would actually have a distribution corresponding to the variable $Y$ (that is a zero-coupon bond maturing in one year. If the bond matures in "$n$" years, then the denominator is of power $n$: $(1+X)^n$)

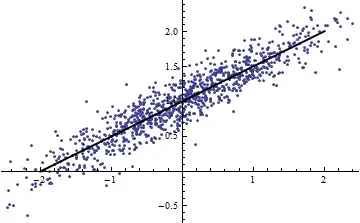

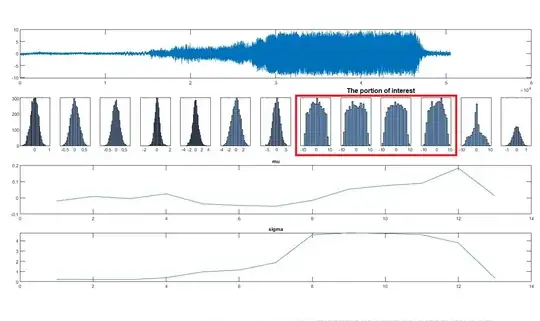

I ran a simple simulation in Python to plot $X$ and $Y$, with $X_0=0.01$, $\sigma=0.2$. Then I get a log-normal distribution for $X$ (as, of course, expected):

For $Y$, the shape of the graph resembles a log-normal random variable, but rotated around its mean axis (i.e. longer left-tail instead of longer right-tail): just by eyeballing the graph, I would think that perhaps the PDF and CDF are well defined, but before diving into attempting the algebra, I wanted to check here whether this problem has a standard solution?