I am working on an price optimization problem for a Real Estate company. Basically, we'd like to optimize their rental price to maximize revenue on their properties.

I have submarket level data such as rental price, occupancy rate, comparable units, operating expenses (fixed cost) in the market, etc.

So for a given set of prices p = {40....60}, the objective is to find the optimal price point i.e the point where marginal revenue => marginal cost.

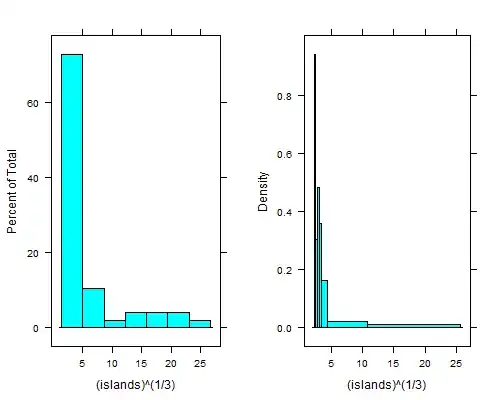

The first answer on this question is one of way of doing it, however, I may not always have probability distribution and the relationship between price and predicted occupancy is non linear:

Simple Linear: ()=+×() where is a scaling constant. Implies that price and probability are linearly related. 2

I have attempted to use log-log regression to calculate elasticities:

import statsmodels.formula.api as sm

mod = sm.ols(formula = 'np.log(Occupancy) ~ np.log(Rent) + np.log(Income) + np.log(unemp) + np.log(comparable)', data=df).fit()

mod.summary()

The regression above fits price and economic control variables on occupancy rates.

With R-Square of 0.94, I am suspicious of this model and there is likely an endogeneity problem. What non-linear methods can I fit to find the optimal rental price. Open to any other ideas/suggestions as well.