I'm regressing two time-series against one another, and I'm struggling with how to interpret an ADF test: does a low value indicate that a series, once detrended, would be stationary; or does it show us that the series, as-is, is stationary?

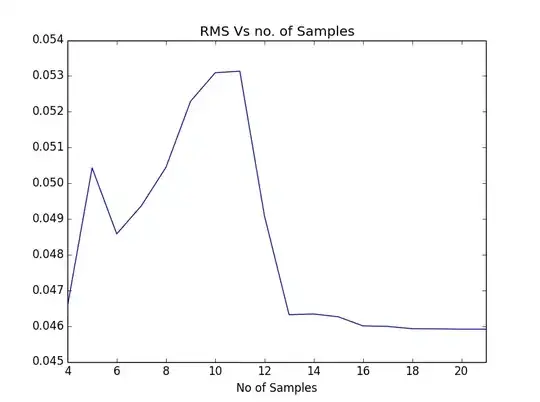

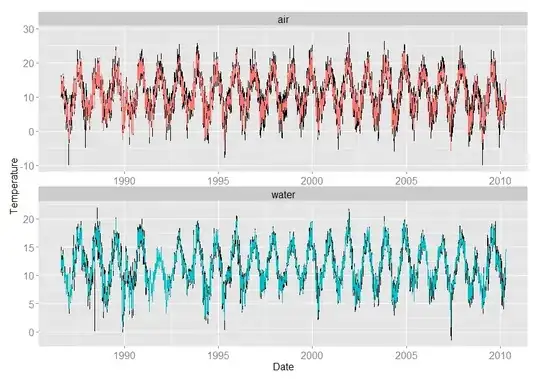

The following data:

Yields a low p-value:

result = adfuller(df_temp['past_flow'])

print('ADF Statistic: %f' % result[0])

print('p-value: %f' % result[1])

ADF Statistic: -3.711959

p-value: 0.003948

And is clearly trending. The low p-value, plus the answer to this question: ADF test showing stationary for a non stationary series leads me to think the interpretation is: after detrending this series, it will be nonstationary, so I should input it into my model as...

df_temp['past_flow'] = signal.detrend(df_temp['past_flow'] )

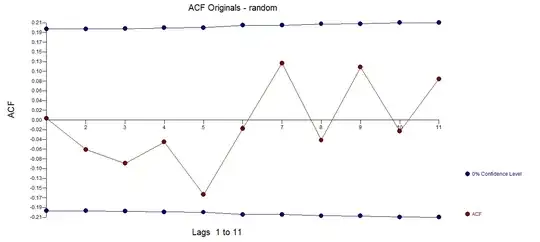

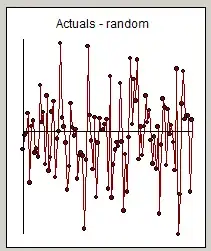

Yet the following random series, which is clearly not trending, also has a very low p-value and clearly need not be detrended:

random = np.random.randn(100)

result = adfuller(random)

print('ADF Statistic: %f' % result[0])

print('p-value: %f' % result[1])

ADF Statistic: -9.811503

p-value: 0.000000

pd.DataFrame(random).plot()

random = array([-4.39319784e-01, -1.03080670e-01, -5.53292685e-02, 4.30390800e-01,

-1.22508404e+00, 1.09712370e-01, 2.51458864e-01, -5.11956802e-01,

-4.17600226e-01, -6.09137055e-01, 1.09473893e+00, 2.07029234e-01,

4.44881165e-01, -7.96475010e-01, 8.33734139e-01, -9.47236313e-01,

-6.24317595e-01, 4.62967411e-01, 7.14135902e-01, -1.10242864e+00,

-1.87361538e-01, -1.80385301e-04, 2.09141082e+00, 3.22407444e-01,

1.02600842e-01, -2.74499764e-01, -1.39960657e+00, -8.41464558e-01,

6.63501807e-01, 9.55240028e-02, -1.07840258e-01, 4.23459691e-02,

-1.14338946e+00, -5.71646684e-01, -5.22755601e-01, -5.83654832e-01,

-2.31595588e+00, -6.79032525e-01, 2.01968695e+00, 3.75643976e-01,

-2.30686144e-01, -9.07550979e-01, 3.29559565e-01, -1.58378648e+00,

-2.81325333e-01, 3.01796807e-01, 1.54915505e-02, 3.34709507e-02,

1.65329155e-01, 2.82163818e-01, -1.37648008e+00, 1.30447978e+00,

-1.58696690e+00, -8.06161905e-01, -4.44394620e-01, -2.68776832e-01,

-3.62723512e-01, 1.13933655e+00, -2.58424888e-01, -1.90011288e+00,

-5.57469346e-01, -1.44175737e+00, -1.52863753e-01, 1.74168276e+00,

1.57576935e-01, 1.22933257e+00, 7.26585983e-01, 1.69562771e+00,

-6.65926948e-01, 1.05264573e-01, -5.73971038e-01, 1.14234285e-01,

8.36729958e-01, 2.07984957e-01, 4.91901097e-01, -2.24177782e-01,

-7.80748937e-01, -1.34282035e-01, -9.02999368e-01, 1.02854538e-01,

-1.97041773e+00, -3.27543438e-01, 7.71490434e-01, 5.64902883e-01,

-8.08799926e-01, 5.21909820e-01, -7.95733399e-02, 1.38749237e-01,

-2.69112011e-01, -9.37119914e-01, 1.48115839e+00, -2.44998321e+00,

-1.49558518e+00, 6.45163727e-01, 1.41655876e+00, 2.81037697e-01,

3.58912414e-01, 3.62404110e-01, -1.45423264e+00, 2.63231934e-01])