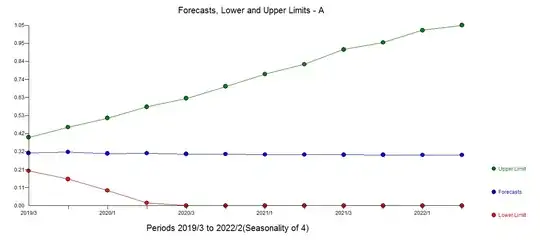

Here is a result in R, using the auto.arima function in the forecast package. auto.arima automatically determines the necessary AR, MA, d, S components and also allows you to include other variables.

> library(readxl)

> A=read_excel("A.xlsx")

> B=read_excel("B.xlsx")

> A1=ts(A$Value,frequency=4)

> B1=ts(B$Value,frequency=4)

> library(forecast)

> mod=auto.arima(A1,xreg=B1,stepwise=F,approximation=F)

> summary(mod)

Series: A1

Regression with ARIMA(0,1,0) errors

Coefficients:

xreg

0.4091

s.e. 0.1570

sigma^2 estimated as 0.002247: log likelihood=126.03

AIC=-248.06 AICc=-247.89 BIC=-243.37

Training set error measures:

ME RMSE MAE MPE MAPE

Training set -0.001337502 0.04678851 0.03242543 -0.3753579 5.792672

MASE ACF1

Training set 0.4114466 0.08525872

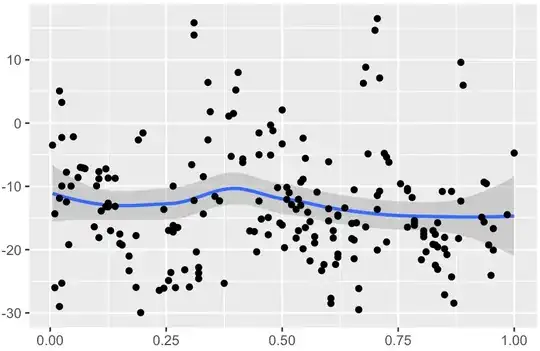

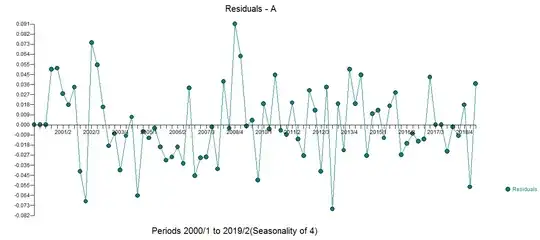

So the selected model contains only 1 term, the lag of B. Check the residuals:

> checkresiduals(mod)

Ljung-Box test

data: Residuals from Regression with ARIMA(0,1,0) errors

Q* = 7.354, df = 7, p-value = 0.393

Model df: 1. Total lags used: 8

Look OK. Let's try a model without B:

> mod=auto.arima(A1,stepwise=F,approximation=F)

> summary(mod)

Series: A1

ARIMA(1,1,0)

Coefficients:

ar1

0.1743

s.e. 0.1114

sigma^2 estimated as 0.002369: log likelihood=123.98

AIC=-243.95 AICc=-243.79 BIC=-239.26

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set -0.001066886 0.04804238 0.03242514 -0.55368 5.841148 0.4114429

ACF1

Training set -0.01470753

> checkresiduals(mod)

Ljung-Box test

data: Residuals from ARIMA(1,1,0)

Q* = 4.033, df = 7, p-value = 0.776

Model df: 1. Total lags used: 8

This model is very similar to the previous in terms of accuracy, and includes only 1 AR term, suggesting that you may as well forecast based on A alone.