I want to investigate the relationship between stock traders' past success rate (i.e. the number of total winning trades divided by the total trades executed) on the status of their current trading decision. The current trading decision is the dependent variable and is a categorical variable that takes the value of 1 if the trade is a win, -1 if it is a loss and 0 if the trader decides not to trade.

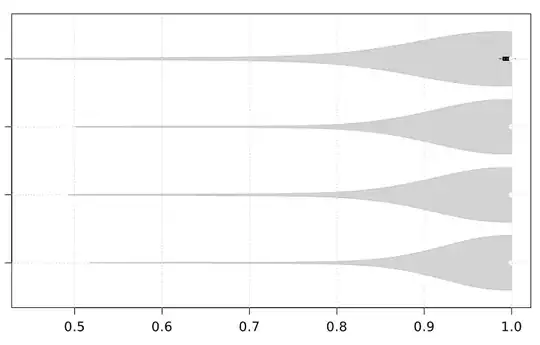

I am conducting a multinomial regression where the dependent variable is the current trade decision (1,-1,0) as mentioned above and the independent variable is the trader's historical success rate.

I choose a multinomial model rather than an ordinal model since, in my opinion, the 3 states are really independent. If the trader traded and made a profit of 0, then it would make sense to categorize the decision as an ordinal variable. But since trading (whether win or lose) is not the same as not trading then I argue that this should be a multinomial variable. Nevertheless, the relationship between win and lose is relative/ordinal. Is my reasoning correct here?

Given that no-trade is the baseline, I obtain the following results from the R output

I am not very clear on how to interpret the output in this case. I tried to follow the example here. The R output states that these are coefficient values and not log odds. Does this mean that a 1 unit increase in historical success rate increases the log odds of winning by 1.224 and decreases the log odds of losing by 0.622? Or are these coefficients? How should I interpret the results?

UPDATE: R results

Call:

multinom(formula = formula, data = data)

Coefficients:

(Intercept) Success Rate Cummulative_NumTrades

-1 -3.601953 -0.622 -1.304052e-05

1 -4.660911 1.224 -1.342798e-05

Std. Errors:

(Intercept) Success Rate Cummulative_NumTrades

-1 8.630168e-08 2.734970e-08 1.341129e-06

1 1.016195e-07 4.889536e-08 1.161023e-06

Residual Deviance: 392352.8

AIC: 392376.8