I have approximately 2000 daily data which contains total daily sales and median price of sales for a particular product.

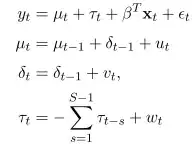

I read the paper but the level of bayseian math is too high for me but from my past experience with price elasticity, I think if I provide median price as dynamic regression component in bsts model then I can get price elasticity distribution for free. The image below is noted as the "basic strucutural model" by the author in his paper "Predicting the Present with Bayesian Structural Time Series".

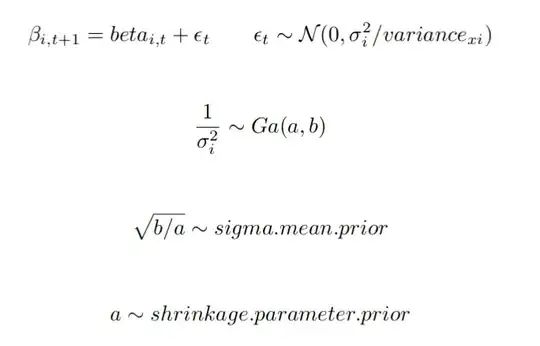

However, the notion of dynamic regression is not fully discussed in the paper. The following is screnshot from the package PDF in CRAN.

My intuition is that if median price, $x_{t}$, is modeled over time against the demand, $y_{t}$ then I compute pseudo price elasticity, $beta_{i,t}$.

Is this intuition completely wrong? If yes, what approach would you suggest to dynamically model price elasticity over time? If no, how can I convert the "pseudo" price elasticity to actual price elasticity?