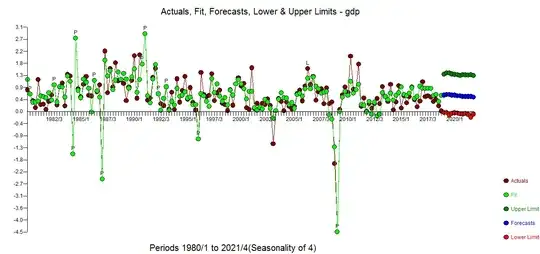

I was given 2 forecasts: Scenario 1 and Scenario 2 for EU GDP. How can I calculate 2 scenarios (forecasts) for Germany GDP? a) There is a strong correlation between (historic) EU GDP and Germany GDP b) EU GDP is impacted by Germany GDP.

At first I thought that I can predict Germany GDP using sARIMA and later to apply shocks from scenario 1 or scenario 2 to the predicted germany gdp data. However, I am not sure how to make different shocks between EU and Germany, should I scal them using correlation? Any ideas or hints are welcome.

[edit] Added data CSV files

There are 2 CSVs:

a) Example_historic.csv with historic data for Germany and EU

b) Example_forecasts.csv with 2 scenarios for the EU.

Goal: how to build 2 forecasts for Germany?