I want to generate 500 simulations of my original return time series.

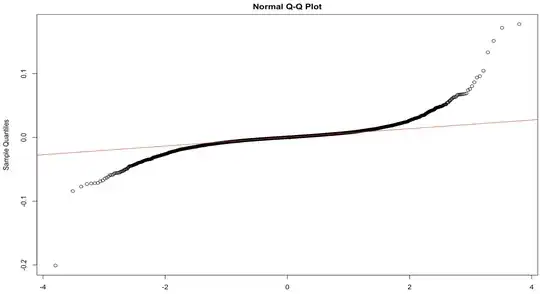

My original return series (n = 4000) exhibits significant serial autocorrelation at lag 1 & 2, is non-normally distributed (according to Kolmogorov-Smirnoff's test for normality) and exhibits positive excess kurtosis & skewness. Typical properties of financial time series data.

In order to simulate an artifical return time series which exhibits the same statistical properties as my original return series, the parametric residual boostrap is used. This is, the estimated model residuals are resampled with replacement with equal propability. The scrambled residual series is then used in conjunction with the estimated model coeffcients to compute a new artifcial return series (see Chandrashekar, 2005).

According to different papers & textbooks, the residual bootstrap requires the residuals to be i.i.d. $N(0,\sigma^2)$.

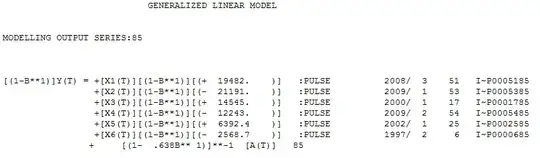

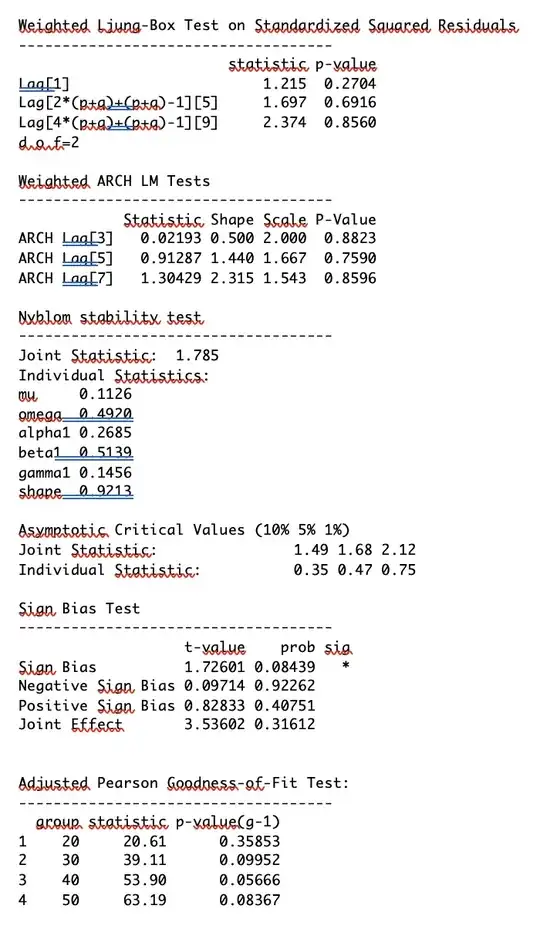

I tested different GARCH specifications. The EGARCH with student-t innovation performed best according to BIC/SIC,Ljung Box and McLeod-Li tests (see output). This is, the standardized residuals are not serially autocorrelated and not heteroscedastic.

However, when plotting my residuals gaussian normality is not met.

Question 1: Is it a problem to conduct a residual bootstrap if residuals are not gaussian normally distributed?

Question 2: However, Pearson's asjusted Goodness-of-Fit says, that the the empirical distribution of the standardized residuals correspond to the theoretical one from the chosen density (here student t distribution).. Does that mean that the innovations are correclty specified? Is this result implicating a good model. Hence, i should use this model?

References

- Chandrashekar, Satyajit. "Simple technical trading strategies: Returns, risk and size." (2005). SSRN.

- Marshall, Ben R., Rochester H. Cahan, and Jared M. Cahan. "Does intraday technical analysis in the US equity market have value?." Journal of Empirical Finance 15.2 (2008): 199-210.