A rather frequent problem in causal inference is that we come across various shocks over time and try to measure their impact.

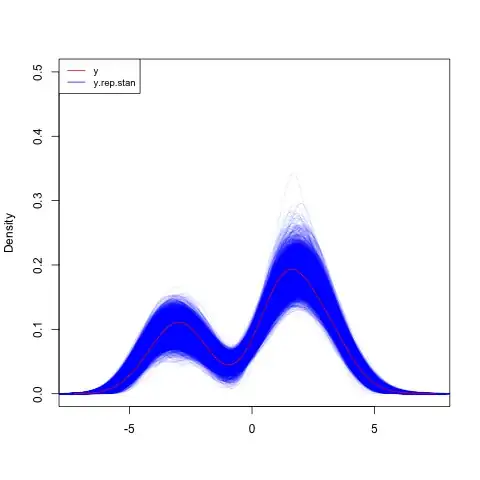

In the case of a single shock we can use bayesian methods to predict how much would be the "continuation" of the series without this exogenous shock and to attribute the displacement of the series to the shock.

Example from CausalImpact package (python/R):

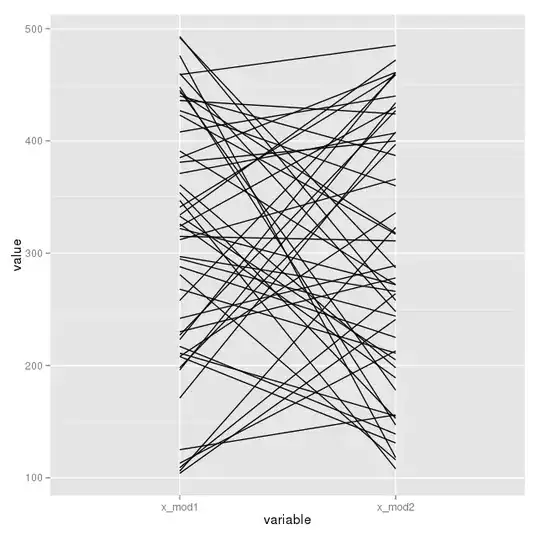

In many cases we have several small shocks which makes this simpler approach difficult.

Example (blue line represent an event over time and red bars exogenous shocks):

What would be the correct approach to this problem?