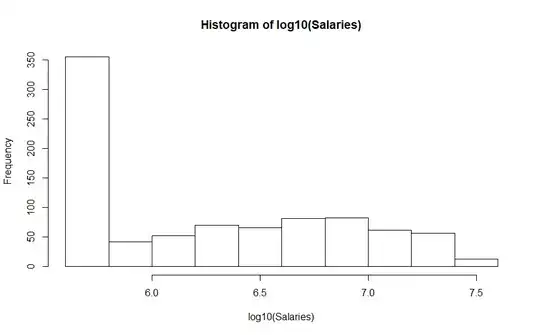

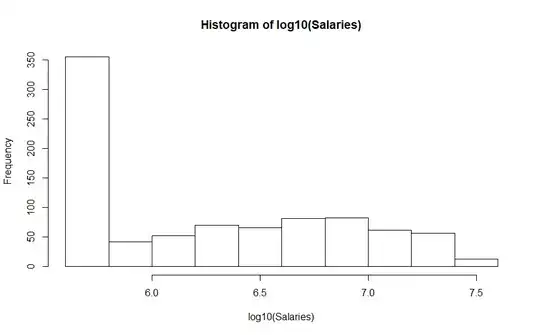

I downloaded last year's salaries. It is very likely they follow a Pareto distribution. The histogram is shown below.

The pdf of the Pareto distribution is $$\frac{\alpha{x_m}^\alpha}{x^{\alpha+1}}.$$

The scale parameter $x_m$ is \$545,000, the lowest salary last year. I estimated the shape parameter, $\alpha$, as 0.7848238 using MLE. This matters because when $\alpha<2,$ then the distribution has no variance. More properly, its variance is undefined. If any of your variables lacks a mean or a variance, then you cannot use anything that minimizes squared loss.

The distribution of the log of the variables does have a variance and so you can use least squares style methodologies on them. This is actually a serious omission from your textbook. Some things, like the stock market returns which have neither a mean nor a variance, or baseball salaries, which lack a variance will make OLS models meaningless. The log is not, inherently, the best treatment, but it does work.

Taking the log does not give you a bell shape.

This is entirely about being certain that all of your data has a variance. If all of the assumptions for OLS are met, then the underlying distributions do not matter. They can be insane looking, but variance has to be defined everywhere.

EDIT As Therkel pointed out in the comments when $\alpha<1$ then no mean exists either. There is a comment by Cliff AB that I should take up as well. He argues that the distribution is doubly bounded and so a finite variance and mean exist. I would disagree with that as an economist. It is true that there is only so much wealth in the world, but it is also true that we have no idea what it is. Furthermore, that wealth is changing every second of every day as people make individual choices.

The worker who does not pick that one apple reduces wealth if that apple is never picked and reduces available wealth regardless. An apple on a tree has no income value until it picked and processed. This makes the right-hand side constraint stochastic. For the purposes of baseball, the stochastic effect should be considered to be zero.

Baseball, as a percentage of world output, is so miniscule that you could ignore it. The same is true for American football, North American hockey, or for that matter, live stage theater for the whole United States.

The fact that you can model this data with a Pareto distribution means you have no mean or variance if the estimates are valid. If you take the log, you end up with finite variance. If you divide the data by its minimum value and take the logs, you end up with the exponential distribution, which is well enough behaved, but then you get interpretation problems.