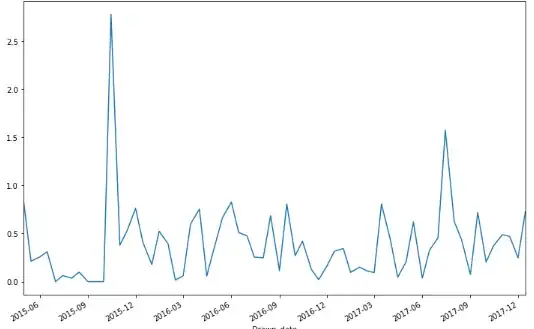

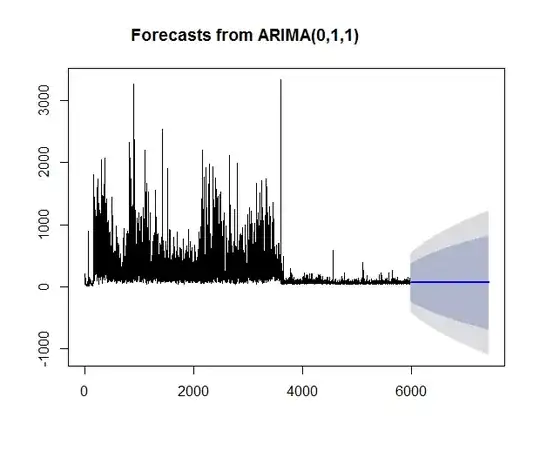

I am working on a bimonthly data where I have customer the customer's sales amount. I tried to plot the original series in python and the plot

import matplotlib.pyplot as plt

Cust_bimonthly_Data['Customer_Sales'].plot(figsize=(12, 8))

plt.title('Cust Bimonthly Daily')

plt.show()

I tried to plot the above time series in Python and it looks like this

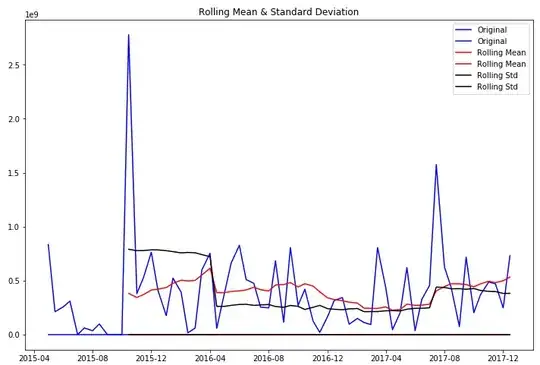

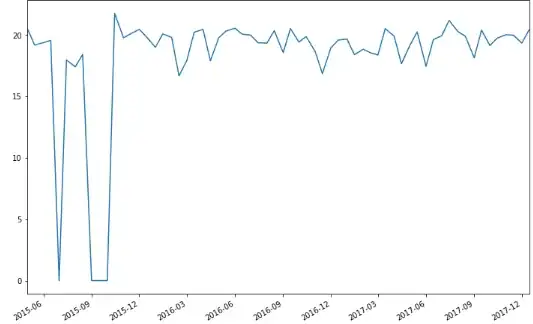

In order to remove this big peak in my data which was an outlier I did log(x+1) transformation on my data i.e. increased all the values to 1 and then did a log transformation

Cust_bimonthly_Data['new_Customer_Sales'] = Cust_bimonthly_Data['new_Customer_Sales']+1

taking the log so as to remove the outliers

Cust_bimonthly_Data['log_cust_sales']=np.log(Cust_bimonthly_Data['new_Customer_Sales'])

**the log transformed series looks like this **

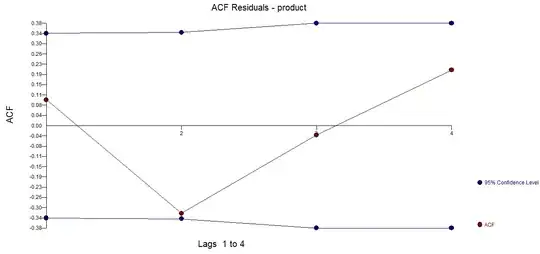

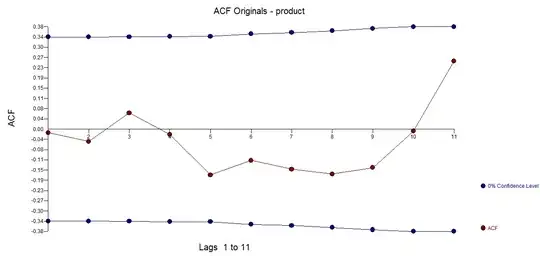

In order to check if my log transformed data is stationary or not I did a ADF test and this is what my results look like

Dickey Fuller test to check if the series transformed series is stationary or not

from statsmodels.tsa.stattools import adfuller

Cust_bimonthly_Data_test= Cust_bimonthly_Data_drop.iloc[:,0].values

result = adfuller(Cust_bimonthly_Data_test)

(-4.8014847417664424,

5.4031369234729222e-05,

0,

63,

{'1%': -3.5386953618719676,

'10%': -2.591896782564878,

'5%': -2.9086446751210775},

150.10425215395222)

question?

Since this test is rejecting the null hypothesis that my series is not stationary , should I still go ahead and perform the decomposition and differencing part. I mean will all those things would still be required since I can see the test tells me that my series is now stationary