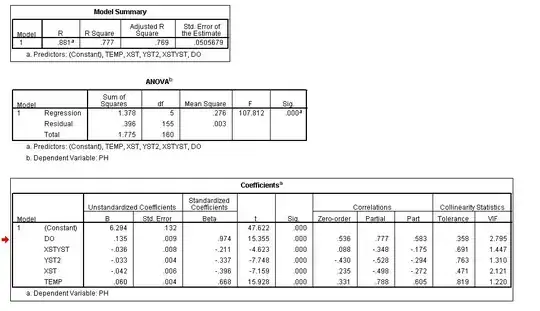

This is the result I've got after running linear regression analysis in SPSS:

I am a bit confused why the sum of squared part correlations is not equal to (or less than) R squared, but rather exceeds the value of R squared (R squared = 77.7%, the sum of the squared part correlations = 88.6%).

Edit

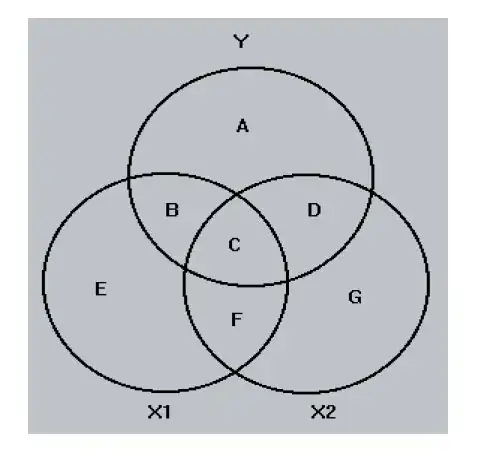

The variance of each variable is represented by a circle of unit area. Total area of Y covered by the X1 and X2 areas represents the proportion of Y's variance accounted for by the two independent variables (areas B,C and D). B and D are portions of Y that overlap uniquely by X1 and X2. The area C is the overlap of both X1 and X2 with Y. The unique areas (B and D) are squared part correlation coefficient. The part correlation between Y and X1 from which the X2 have been removed - area B.

R squared is the amount of variance in the dependent variable explained by all variables together.

So, it sounds logical that the sum of the squared part correlation cannot exceed the value of R squared. Or I am wrong?