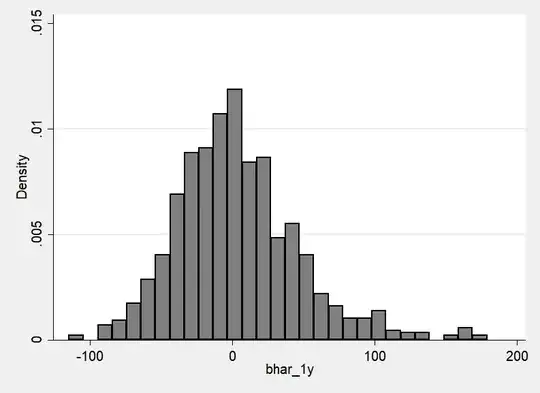

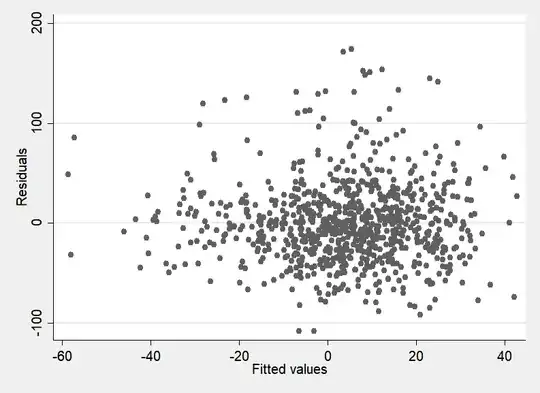

I am analyzing buy-and-hold abnormal returns of stocks (dependent variable) using OLS regression. These returns, however, tend to be positively skewed (and are so in my case). The residuals obtained by OLS are slightly skewed (skewness of 0.921 and kurtosis of 5.073).

Although the histogram of residuals looks quite normal, I am concerned about the heavy tails in the qq-plot. Is it valid to assume that the residuals are approximately normal or is the normality assumption violated in this case?

I already tried to transform the dependent variable using log-modulus and cube roots (as there are negative values) in order to get a smoother qq-plot, but did not get improved results.