I downloaded data from yahoo to study all the statistics of the time series.

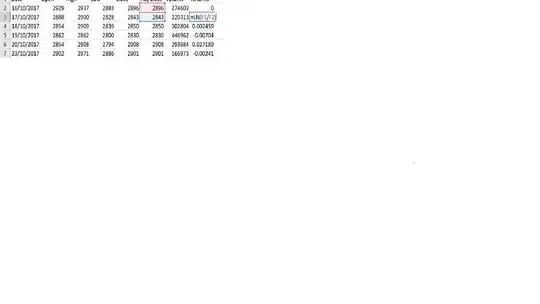

I then calculated the returns by using: $Ln(\frac{S_t}{S_{t}-1})$ using the adj close price in the following excel file:

Then I calculated the daily mean using the =AVERAGE function, Variance using the =VAR function, Volatility, skewedness and kurtosis and I plot an histogram. To check if the time series comes from a Normal Distribution.

To check if it in fact comes from a normal distribution I can test it using different statistic tests such as:

• The Kolmogorov-Smirnov test (K-S) • Shapiro-Wilk (S-W)

• D’Agostino-Pearson omnibus test or

• Jarque-Bera test

Or I also saw to follow a normal distribution my data should have a skweness= 0 and kurtosis=3.

But because in my case my skewness is = -0.56 and kurtosis is= 8.7 I can find the Standard Deviation error for both and by definition:

If the absolute value of the skewness for the data is between +/- twice the standard error this indicates that the data is symmetric, and therefore normal.

Similarly if the absolute value of the kurtosis for the data is between +/- twice the standard error this is also an indication that the data is normal.

I am confused, is it enough to show the above conditions regarding the skweness and kurtosis to show that my data follows a Normal distribution or should I use the above statistic tests? And which one is better when we are dealing with log returns?

Another question that I have is I know that $r_t = N=(\mu,\sigma)$, we assume that $r_t$ is:

$r_t=\mu +\sigma\epsilon_t$

Normally distributed and independent with mean µ, and (stdev) σ.

$\epsilon-> N=(0,1)$ and $\sigma\epsilon_t=> N(0,\sigma)$

In my understanding the $r_t$ are the erros of the time series, and I found that this time series is called a constant return model but I am not sure if this is correct, can anyone clarify this?

So, this means that the model is then given by:

Unconditional 1st moment mean: $E[r_t]=\mu$

Unconditional 2ns moment variance $Var[r_t]=\sigma^2$

The 3rd and 4th moments are:

Skweness: $\frac{E[r_t-\mu^3]}{\sigma^3}$

Kurtosis: $\frac{E[r_t-\mu^4]}{\sigma^4}$

The model is then: $Ln(S_t)=Ln(S_{t-1})+\mu+\sigma\epsilon_t$ which is a randon walk.

Is this correct? I am a bit confused regarding the $r_t$ which I believe that represents the errors of this time series and the model given by: $Ln(S_t)=Ln(S_{t-1})+\mu+\sigma\epsilon_t$.

Also, I am not sure if the mean and variance uses the unconditional formula.

Can anyone help me on this?

Thanks