I am studying share price log returns and AR(1) model.

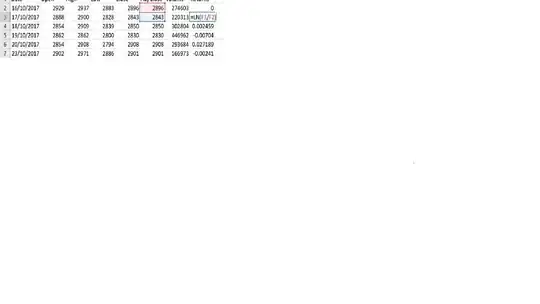

I downloaded data from FTSE100 and used the Adj.close column to find the Ln returns:

Now I am trying to understand how can I estimate an AR(1) model using this information. I understand the AR(1) model, I did a couple of example in excel, but I do not understand how the ln returns are related to that. AR(1) is given by:

$X_t=\phi+\alpha*X_{t-1}+\epsilon$

I assume that I need to find values for $\phi$ and $\alpha$ to try to fit the AR(1) model but I am confused. Can anyone help me on this? Thanks.