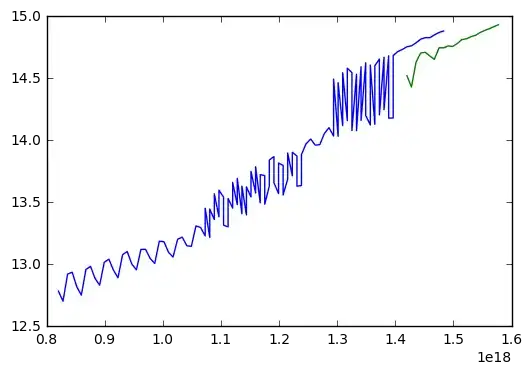

I'm building a model which predicts the GDP(Quarterly) of my country. I've lots of time-series predictors(~50(Monthly), all continuous, e.g. Index of Industrial Production, etc.) but my dataset size is small(~120). I've tried using ARIMA(5,1,0) on GDP values:

I'm looking for a model which could take into account how predictors affect GDP along with past GDP values.

Should I try using Recurrent Neural Nets on such small dataset?

Also, I used log-transform to account of increasing variance in GDP values, which still hasn't solved the issue completely. Any suggestions on how to solve this would be amazing.

I'm using Python.