I have trained an Autoregressive Conditional Duration (ACD) model on some transactions data. Then, I test it against some other transactions data to check how well it predicts the time interval between two trades.

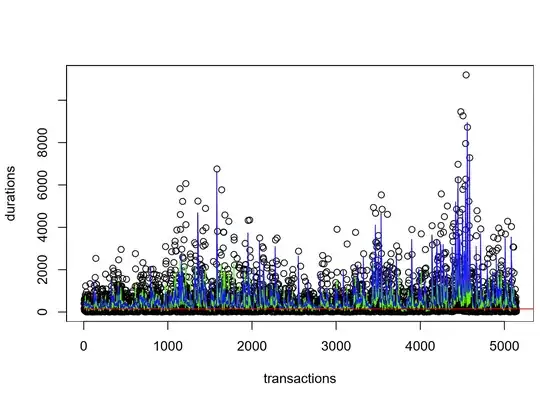

Optically, the results seem OK (cf. Figure).

In blue, the ACD predictions; In green, the values of moving average using the last 5 durations; In red, the value of the median in-sample.

In blue, the ACD predictions; In green, the values of moving average using the last 5 durations; In red, the value of the median in-sample.

If I report the errors as "the median (or the mean, or a different quantile) of the absolute errors between the real value and the predicted value", then I obtain that the in-sample median is the best model though it doesn't capture the dynamics at all!

What would be a 'fair' way to benchmark this model?