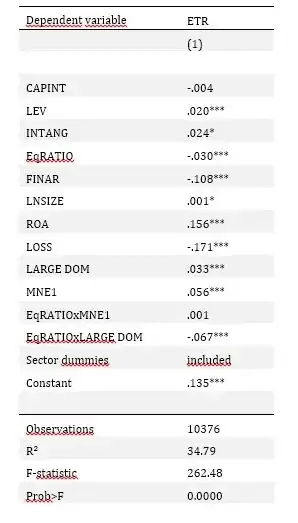

Short summary: I want to examine of a multinational has a higher or lower effective tax rate ( ETR=dependent veriable) compared to small companies and large domestic companies. ( categorical variable 1=SME ; 2= large domestic and 3=MNE) However, I do not Know if I can tell in the end this is true, because main effects and interactions have other signs. What if I include (according to theory) another interaction term, how can I interpret the dummy variable MNE...

Can I conclude from this regression that being a MNE increases the ETR by 5,6% ( holding the other variables constant)? I red that the main effect of the variables in the interaction term have to be interpreted as the effect of that variable for the reference group ( SMEs in my case). But what can I conclude now if I interpret both main effect and interactions: that being a multinational on average increases the ETR by 5,6% or and that multinationals with a higher equity ratio decrease the ETR by -6,7% compared to SMEs ( so that multinationals with a higher equity ratio have on average actually a lower ETR compared to SMEs (5,6% -6,7%= -1,1).... Help