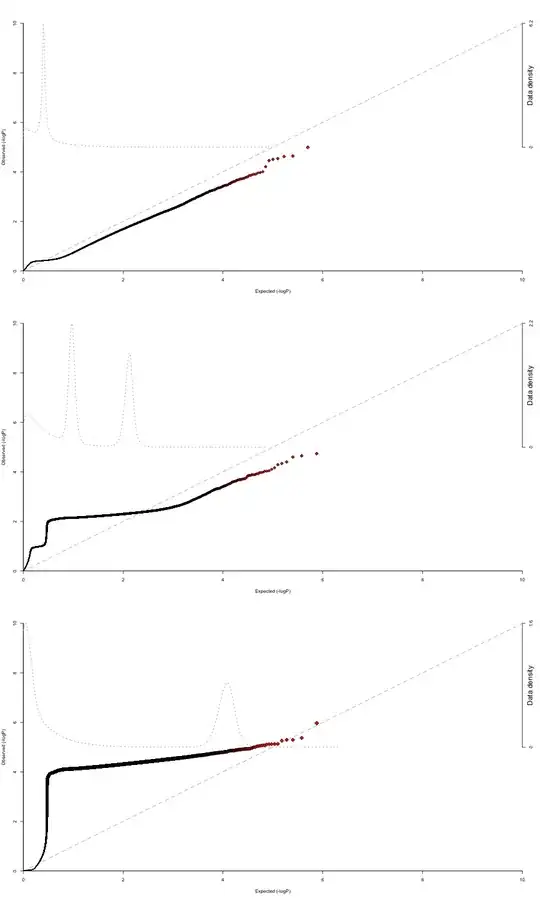

Showing that an observed time series is non-linear is notoriously difficult. Briefly, you would have to find a measure indicating nonlinearity (e.g., a positive Lyapunov exponent or a non-integer dimension) and then show with surrogates that the value cannot be explained by the linear properties (frequency and amplitude distribution) of the time series.

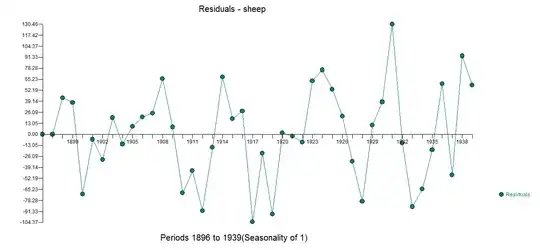

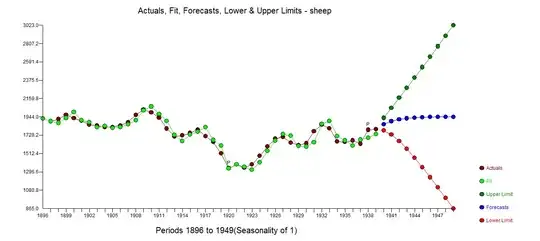

Your time series is too short for this. Your data points are few in comparison to what is needed to expect a useful result from non-linearity measures. Then you have at most two periods of your main oscillation in your data, which is far too few for any useful analysis. Finally, you have an obvious trend in your time series making the time series non-stationary (at least for the purposes of analysing it – if this is due to a stationary oscillatory behaviour, you would have to have data from at least one oscillation to make any use of this). You can correct for this by subtracting a linear trend, but you have to expect that this is not the only effect of the non-stationarity.