I have a group of time series variables and I want to found out the relationship among them. The method I use is to calculate pair-wise correlation between two time series and found out those with high correlation values and statistical significance (P<0.05 && Q <0.05).

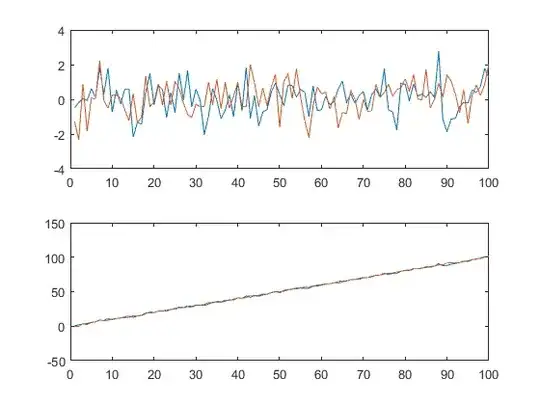

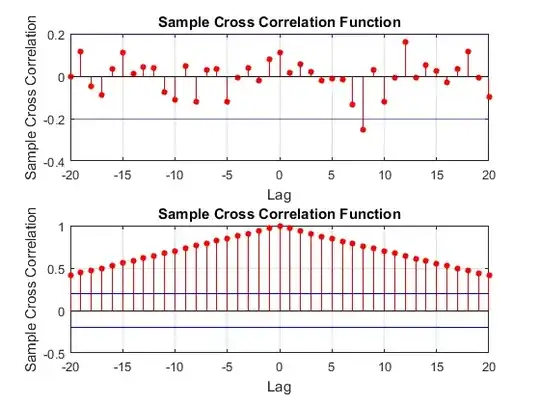

However, When I checked literature, there were some papers mention that if the time series have auto-correlation themselves, the P value of the cross-correlation would be unstable and the correlation coefficient would be inflation and I have validate the inflation in my data set by using ARIMA module to detrend and calculate the cross-correlation between residues.

My question is, as my aim is to find out those have strong correlation time series pairs, the series have the same trend actually are those pairs I want to find, should I do the cross-correlation after detrending? I am afraid that some time series have the same trend could be detected by the correlation analysis however can not be detected after detrending.